I’m so pleased to get 52 Traders monthly market predictions/forecasts/outlooks (whatever you want to call them) launched to help aspiring traders and investors see how professional traders take a monthly view of the markets, how they do their analysis and what sort of things you should be thinking about when you do your own.

I’m so pleased to get 52 Traders monthly market predictions/forecasts/outlooks (whatever you want to call them) launched to help aspiring traders and investors see how professional traders take a monthly view of the markets, how they do their analysis and what sort of things you should be thinking about when you do your own.

Please note: The predictions below are for educational and entertainment purposes only, they are not financial advice and should not be used to make financial decisions of any kind.

This November we have a great mix of predictions, my favorite being Nick’s Bitcoin prediction. I’ve noticed the popularity of this Cryptocurrency and cryptocurrencies in general has skyrocketed in the past month. This is clearly seen by Bitcoin breaking $5000 last month and November’s bitcoin prediction forecasts even further growth.

Another popular one is Tesla. I don’t trade stocks, but it’s great to see a high profile stock appearing in these predictions and in-depth analysis from Anka – who was interviewed on the podcast way back in 2015 when it first started.

It’s also very interesting to see two different takes on the EURUSD pair, Andre says up and Dale says down. Maybe one will be right and the other wrong or they’ll both be sort of right if there are some sharp moves in both directions. Can’t wait to see what happens!

So, without further ado, use the quick links below to find your favorite markets or dive straight in and soak up the analysis from these expert traders:

- E-mini S&P 500 by Art Collins

- EURNZD by Rob Colville

- Bitcoin (BTCUSD) by Nick Bencino

- AUDUSD by Harllan Dale

- USDJPY by Daniel Cheung

- Severn Trent (FTSE Stock) by Samuel Leach

- EURUSD by Trader Dale

- GBPUSD by Shonn Campbell

- TSLA by Anka Metcalf

- Bonds by Trader Scott

- AUDUSD by Shope Aina

- EURUSD by Andre Stewart

- EURGBP by Vladimir Ribakov

November 2017 Market Predictions

E-MINI S&P 500

S&Ps Should Power Higher Through End of Year

By Art Collins of ArtCollinsTrading.com

The end of the year is historically a seasonal up move in the stock related markets. I’ve noted November market moves in a variety of futures markets–not just stock-related, and the most pronounced bias I’ve seen is a rise in the S&P futures. Obviously, some years are going to go counter-seasonal, but why anticipate a reversal of the trend when it’s statistically so much more rewarding to go with it?

The end of the year is historically a seasonal up move in the stock related markets. I’ve noted November market moves in a variety of futures markets–not just stock-related, and the most pronounced bias I’ve seen is a rise in the S&P futures. Obviously, some years are going to go counter-seasonal, but why anticipate a reversal of the trend when it’s statistically so much more rewarding to go with it?

EURNZD

Is EURNZD Poised for a Major Reversal?

By Rob Colville of TheLazyTrader.com

In this video, we discuss the technical factors which supports a long-term EURNZD reversal …enormous profit potential (weekly timeframe).

In this video, we discuss the technical factors which supports a long-term EURNZD reversal …enormous profit potential (weekly timeframe).

Discover exactly what we saw and the evidence we weighed up to come to this conclusion so you don’t miss out on the next opportunity!

Bitcoin (BTCUSD)

Bitcoin Heading to $7,000 USD?

By Nick Bencino of Forex4Noobs.com

It looks like nothing can stop Bitcoins meteoric rise up, except maybe the hard fork due for mid to end November (some say as early as the 16th) . Will it hit $7,000 before the fork? In this video I discuss my predictions for Bitcoin in the coming month!

It looks like nothing can stop Bitcoins meteoric rise up, except maybe the hard fork due for mid to end November (some say as early as the 16th) . Will it hit $7,000 before the fork? In this video I discuss my predictions for Bitcoin in the coming month!

AUDUSD

The Big Zero Sum in AUDUSD

By Harllan Dale

AUDUSD is at the right spot to begin its reversal. An Impending 400 pips to 1000 pips minimum is about to happen.

AUDUSD is at the right spot to begin its reversal. An Impending 400 pips to 1000 pips minimum is about to happen.

Harllan Dale’s AUDUSD Prediction

USDJPY

USDJPY Is Boxed In But A Good Push Is Due

USDJPY, on the Daily its actually ranging/boxing within the 800 AOA region (black and teal lines) so following this will most likely have a good push coming soon. The fact its making higher highs and lower lows is quite fun.

USDJPY, on the Daily its actually ranging/boxing within the 800 AOA region (black and teal lines) so following this will most likely have a good push coming soon. The fact its making higher highs and lower lows is quite fun.

USD basket is on a retracement so north looks positive and confirming the USDJPY.

Thought GBPJPY and EURJPY looking lower so best to wait this one out and see what the week brings good news coming in to set a strong trend coming through.

Daniel Cheung’s EURJPY Prediction

Don’t Miss December’s Market Predictions – Click Here

Severn Trent (FTSE Stock)

We All Need Water

By Samuel Leach of SamuelandCoTrading.com

Severn Trent Entry at 2100 target for your month prediction is 2280 but overall goal at 2400. I explain about Severn Trent and my reasons in my new YouTube Series where I really break the stock down.

Severn Trent Entry at 2100 target for your month prediction is 2280 but overall goal at 2400. I explain about Severn Trent and my reasons in my new YouTube Series where I really break the stock down.

EURUSD

Follow the volumes of institutions

By Trader Dale of Trader-Dale.com

There has been a strong buying activity on the EUR/USD since the start of the year. Institutions were clearly adding to their long long positions and pushing the price to new highs. In my prediction, I identify places where most of the institutions placed their long positions. Those places are easily spotted with a yearly Market Profile which shows volumes of positions they entered.

There has been a strong buying activity on the EUR/USD since the start of the year. Institutions were clearly adding to their long long positions and pushing the price to new highs. In my prediction, I identify places where most of the institutions placed their long positions. Those places are easily spotted with a yearly Market Profile which shows volumes of positions they entered.

If there is a pullback to a place where lot of institutions have their long positions, these institutions will defend their positions and they will intervene aggressively. This mean that they will initiate another strong and aggressive activity to shift the price higher once again.

After the ECB meeting last Thursday there was also pretty strong selling activity. For that reason I published a more risky short trade with tighter SL. The logic behind this short trade is that there were some pretty massive volumes placed in the market right before the strong sell-off. This could be a sigh of strong sellers accumulating their selling positions and pushing the price lower. Again – if there is a pullback, those sellers will try and defend their short positions and they will start aggressive selling to try and push the price lower.

GBPUSD

Several Hundred Pips of BOOM Coming

By Shonn Campbell of ShonnCampbell.com

I am super excited to buy the GBPUSD in the coming weeks when I have the opportunity. The Weekly and Daily charts are showing some excellent price action potential. All we are waiting on is some 4 hour chart cooperation and it will be go time. Check out the video for all the details.

I am super excited to buy the GBPUSD in the coming weeks when I have the opportunity. The Weekly and Daily charts are showing some excellent price action potential. All we are waiting on is some 4 hour chart cooperation and it will be go time. Check out the video for all the details.

TSLA

We Are Spotting A Buy Opportunity In Tesla

By Anka Metcalf of TradeOutLoud.com

After setting a double top the stock entered into a correction back to support levels (prior visited on 7/10, 7/17, 8/2 )…so what did traders and investors do each time when it has tested these levels? Buy….Last Friday 10/27 $TSLA has reached this level again, no trading at $320.00 area. The stock has also pulled back to the 200 ma, a rising 200 ma that serves as additional support. Take a listen as I point out what my entry is …

After setting a double top the stock entered into a correction back to support levels (prior visited on 7/10, 7/17, 8/2 )…so what did traders and investors do each time when it has tested these levels? Buy….Last Friday 10/27 $TSLA has reached this level again, no trading at $320.00 area. The stock has also pulled back to the 200 ma, a rising 200 ma that serves as additional support. Take a listen as I point out what my entry is …

Bonds

The Big Bond Bear

By Trader Scott of TheEntryPoints.com

US Treasuries are in a secular bear market. The short-end yields bottomed in late 2011, the 30 year on July 8, 2016. But markets zig and they zag. We can have bearish or bullish views all we want, but markets don’t care. And I’m a trader. Being short, and staying short, is very difficult and short covering rallies are brutal. And the other factor which confuses a lot of people, including me for a long time, is the issue surrounding time-frames, and knowing – what is our own time-frame for that particular trade, and what is that specific setup which we are looking to enter into or are currently in. My premarket post below explains a lot of this. But in early December 2016, amid the wildly bearish sentiment, I bought TLT and held it until June of this year. The whole time believing it is just an intermediate rally in a major, multi-decade bear market. I did several posts over the summer about wanting to wait to short bonds until the TLT gap was filled. I finally shorted (bought puts) on 9/7/17, and covered on 10/25 – and am looking to buy March puts if TLT trades above 127.20. The bear market in bonds will be wildly bullish for both the stock market and for commodities.

US Treasuries are in a secular bear market. The short-end yields bottomed in late 2011, the 30 year on July 8, 2016. But markets zig and they zag. We can have bearish or bullish views all we want, but markets don’t care. And I’m a trader. Being short, and staying short, is very difficult and short covering rallies are brutal. And the other factor which confuses a lot of people, including me for a long time, is the issue surrounding time-frames, and knowing – what is our own time-frame for that particular trade, and what is that specific setup which we are looking to enter into or are currently in. My premarket post below explains a lot of this. But in early December 2016, amid the wildly bearish sentiment, I bought TLT and held it until June of this year. The whole time believing it is just an intermediate rally in a major, multi-decade bear market. I did several posts over the summer about wanting to wait to short bonds until the TLT gap was filled. I finally shorted (bought puts) on 9/7/17, and covered on 10/25 – and am looking to buy March puts if TLT trades above 127.20. The bear market in bonds will be wildly bullish for both the stock market and for commodities.

The 10/25 premarket post is below to explain further:

“Global government bond yields across the globe are rallying today (prices falling), with the US leading the way. Back at the beginning of the year, with the world bearish on bonds, I started talking about the likelihood of TLT rallying back into the big gap at around 130 for the next shorting opportunity, when the next leg of the bear market will begin (the top). And in the beginning of September, in premarkets I kept talking about using the TLT rally to short bonds, with put options being a good instrument. On 9/7 I bought October and December puts, and covered the Octobers too early, but kept talking about using a break below 122.50 on TLT to cover the Decembers. And that is still my plan. I bought TLT in premarket as a hedge,and may unwind the whole thing today. And will it be too early? Maybe, we’ll find out, but the sentiment is turning quite bearish, as stories are coming out all over about “why” bond yields are surging. A hint to the millions of of the rear view mirror analysts around the world – bonds are in a secular bear market. I said that exact thing even as I was buying TLT into the wildly bearish sentiment in early December. There is a recent post with the discussion of the big picture in bonds as related to gold (and other assets)”.

Traders Scott’s Bond Prediction

AUDUSD

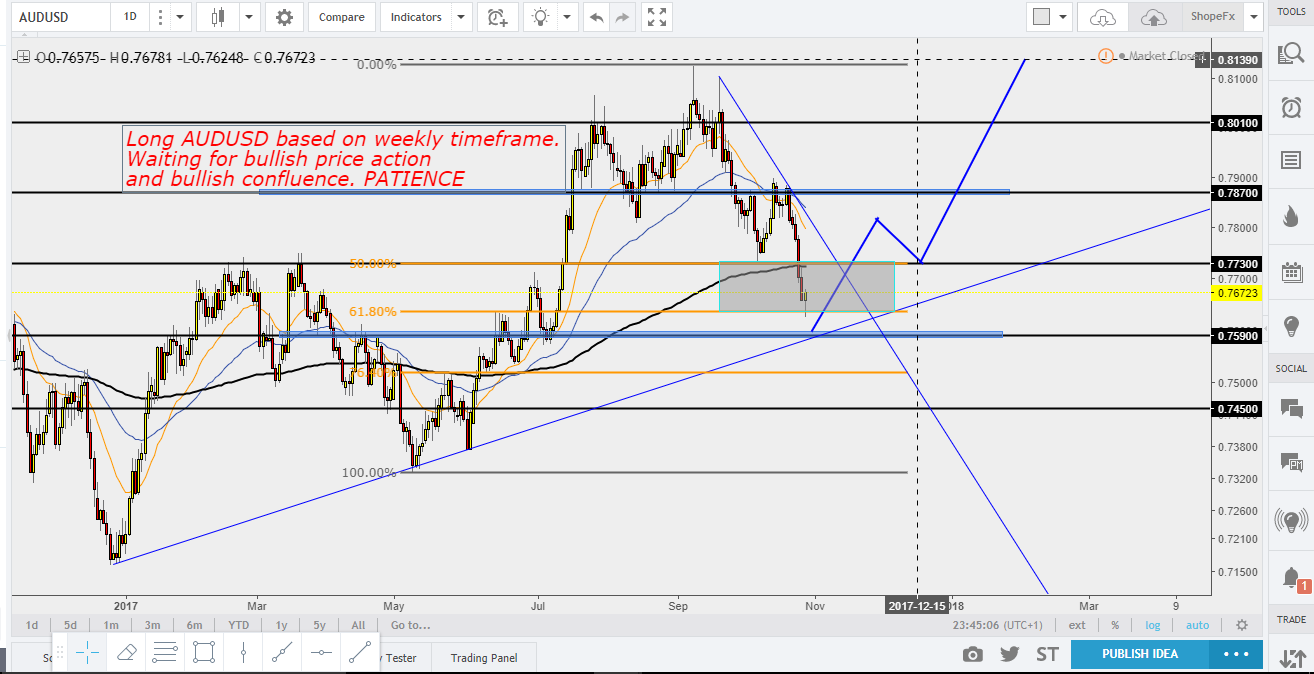

Is AUDUSD about to Explode?!?!

By Shope Aina

Simply analyzing the weekly chart, we can see clear bullish price action with a nice weekly pullback to a high probability Fibonacci area. Moving onto the daily chart, we are seeking bullish price action and bullish confluence in order to bank on the higher time-frame move of the weekly.

Simply analyzing the weekly chart, we can see clear bullish price action with a nice weekly pullback to a high probability Fibonacci area. Moving onto the daily chart, we are seeking bullish price action and bullish confluence in order to bank on the higher time-frame move of the weekly.

Shope Aina’s AUDUSD Prediction

EURUSD

Trump, please make EURUSD erupt!

By Andre Stewart of 52traders.com/mentor/

See the video below, this analysis is based off simple market structure and the current behavior of price in the Euro Dollar. Also if we continue to see further upside in XAUUSD we will see a rise in the Euro as well.

See the video below, this analysis is based off simple market structure and the current behavior of price in the Euro Dollar. Also if we continue to see further upside in XAUUSD we will see a rise in the Euro as well.

EURGBP

EURGBP is on the road for great moves!

By Vladimir Ribakov of TradersAcademyClub.com

EURGBP is creating a wonderful setups, cycles based on the weekly and daily time frames. That gives us a great opportunity to trade it.

EURGBP is creating a wonderful setups, cycles based on the weekly and daily time frames. That gives us a great opportunity to trade it.

On the weekly time frame we are at the end of triple cycle followed by the bearish divergence and bounce from top range. Daily time frames is taking us to critical short term levels that could offer short term retrace.

The cash rate decision in Britain at the beginning of November, should be the trigger for the next move.

Wow! What a fantastic bunch of predictions to sink your teeth into.

One thing I think is clear from these predictions is, when you start to look longer term, fundamentals do seem to play a greater roll in trading and investing decisions. Even though these traders above are mostly technical, you’ll notice how they are all very in tune with the heartbeat of the market, or put another way… it’s not their hobby, it’s their life!

Want to hear more from these traders?

Listen to the 52 Traders Podcast to find out how these traders made it along with their tips, techniques and strategies.