Well, I didn’t think it would be such a long break between updates, but here we are 11 episodes on and I’m back here to let you all in on how I’m progressing with my trading and everything else that’s been going on.

Well, I didn’t think it would be such a long break between updates, but here we are 11 episodes on and I’m back here to let you all in on how I’m progressing with my trading and everything else that’s been going on.

In today’s episode I’ll share:

- An update on my Pro Football (Soccer) career of days gone by

- Cold Therapy update from my last show

- How I grew my trading account 300% since we last spoke (& what happened next)

- Takeaway’s from the last 10 traders

- My BIG Listener Competition – you don’t want to miss this!!

Am I an Ex-Pro Football (Soccer) player?

I had to laugh when one of you listeners sent me an email asking if I use to play football professionally. The closest I managed was playing with and against a fellow Kiwi who had a short career in the English Premier League and was named rookie of the year in the MLS (Simon Elliott for those who know NZ football).

These days I have to make do with Masters 1 (35+ year old’s) football here in Wellington with a team known as “The Grizzlies”.

I don’t do too bad and last weekend helped the team beat last season’s champions 1-0, scoring the winner no less (after running onto a long ball and firing home with the left foot from a mammoth 2 yards!). This is the first ever time we’ve beaten Brooklyn (they beat us 9-0 at the end of last season to win the league on a shockingly cold day, that almost sent me hypothermic). The match was called off after 70 minutes – who knows what the score could have been??

What made this victory even more special was being served by their keeper at the city sports shop later on in the week… Yes, he did recognize me (but no words were exchanged). Haha! Anyway, back to the update.

Cold showers find the “hot spot”

In my last update I challenged you all to take a cold shower to see if it would break some bad trading habits and put you out of your comfort zone so you could become comfortable being uncomfortable.

Well, I was pleased to hear some of you took up the challenge taking your first cold shower. Well done guys!

I must say though, as summer turned to autumn and the cold shower water started to get a bit colder, I did find it hard to keep going and took a week off at one point. But I’m back into it again and finish off every shower with a good solid minute or so of cold (well, freezing cold… to be precise).

What’s funny is that things have all started to align. The same listener who thought I was a pro footballer, told me about the king of cold showers – a guy named Wim Hof (nicknamed the “Ice man”). I checked out his video this week and was surprised to see that cold showers are just the start and there are many other ways of being cold and benefits of doing so. To learn more yourself take a look at this:

My 300% trading account triumph

Last time I spoke about getting back into the markets and trading again. I’d built lots of trading robots as part of my course but had been reluctant to trade them because I would always find an excuse not to.

What I realized after my Rob Booker interview was that I couldn’t just sit on the sidelines anymore. I had to be in it to win it!

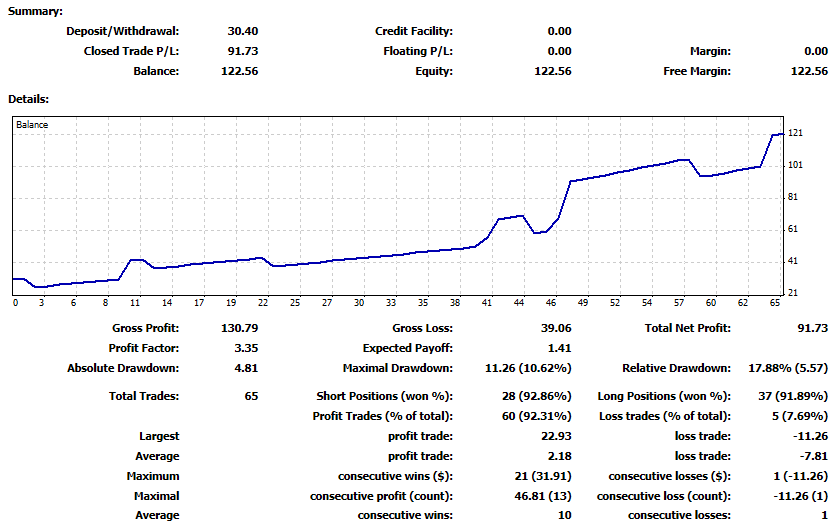

And what a start I had… 300% growth on a tiny $30 account (the smallest account I’d ever traded – that I was obviously happy to lose) was not what I was expecting.

92% winners and the ability to scale up trades and feel confident about it… I thought I would own the world in a few years time.

But, one of my mentors had told me numerous times to close the trades before the weekend. I thought I knew better and then one weekend shortly after I took the screen shot above…

BOOM… a 200 pip weekend gap. And I was on the wrong side of it:

Account blown 🙁

It took me a week to get around to funding the account again and then I was back in with the knowledge that this strategy still had legs, as long as I took a slightly more conservative approach around weekends (I built a filter that stopped the EA from taking new trades on a Friday and closed out any open trades at a loss or profit at 4pm on a Friday).

So, here’s the new account after a week and a half:

Where will I be come my next update? Who knows? My guess is that I’ll have more than one EA running. Probably trading on multiple instruments at higher timeframes.

If you want to join me on this auto-trading journey, head on over to my other site (AutomateMyTrading.com) and get access to this trading robot and any others produced by the thriving community and learn how to build your own robots in the process.

Oh, before I forget, check out the interview I did on the Two Blokes Trading podcast, great guys on a similar journey!

Grab Your Free Trading Robot at AutomateMyTrading.com

Takeaways from the last 10 traders

1) Get hours and hours of chart time

We don’t like to hear this, I know. We have plenty else on in our lives to spend hours staring at the PC screen at home. I mean, we do this for 8 hours a day at work. Home time is for relaxing… Right???

But this was one of the major “success factors” with all these traders. It’s hard, I know. But it’s a sacrifice these guys have made and no doubt many others.

2) Commit a time to trade

We all might like to think of ourselves as traders, but are you like me and dipping in and out of the market when you have a spare 5 minutes? Is it way down your priority list? Would you rather be watching the TV?

I find this one hard myself. I have so much on that to spend concentrated time trading (either manually or automating strategies) is hard. Especially manually for me given I can achieve so much more if I start to automate things.

All my recent guests not only dedicated hours, as per point 1, but they prioritize trading much further up the ladder than most of us. They have created the habit and it forms part of their life. That’s why they succeed at it.

My advice:

Start small, form a habit and grow it:

- Day (or week) 1 pick a 5 minute time slot for trading at the start of the day (do this every day or week, whatever works best), e.g. 8:05pm after dinner and a bit of relaxation

- Spend that 5 minutes solely on effective trading related chart time, e.g. finding setups or back testing

- Day (or week) 2 double the amount of time, i.e. 10 minutes

- Continue doubling it until you reach a comfortable daily allocation

- Review your trading after 1 month and see if you have improved

- Repeat the process from the beginning, if you failed, or continue with the same time slot and amount if you succeeded

BIG LISTENER COMPETITION:

Trading Mentors Match-Off

Finally, here’s everything you need to know about the “Trading Mentors Match-Off” competition.

Firstly, if you are one of our 3 winners you’ll get thousands of dollars worth of currency trading mentor-ship and education for FREE from your mentor.

How it works:

- I have 3 trading mentors lined up Avdo Hadziavdic, Adam Lord and Derek Vanderlinder, ready to take on one student each and turn them into a successful trader right here on the Podcast in front of everyone

- You can enter by leaving a comment below – your comment should try to convince our mentors that you would be a great student by answering there questions (see below) honestly and telling them a bit about your trading story (successes and failures)

- On 27th May 2017 I’ll ask each mentor to choose 3 traders they would like to mentor (based on the comments you leave below)

- I’ll then randomly draw 3 of those 9 traders from a hat (live on my Facebook page – Like the page to see the prize draw LIVE ON FACEBOOK)

- I’ll allocate one trader to a mentor at random

- Each mentor will then take their trader and train them over the coming weeks/months (free of charge – obviously) and we’ll get to follow along to see their amazing journey

How to enter:

- Leave your comment making sure it covers the questions asked by my mentors

What’s required if you win?

- You’ll need to commit the time required by the mentor

- You’ll need to be available for interviews on the 52 Traders podcast (I’ll make sure the time suits your schedule)

- You’ll need to provide a picture (head shot) of yourself to be displayed on this website

- (optional) You may be asked by your mentor to undertake some hypnosis to help with your trading mindset

Please answer these questions (from my mentors) in your comment:

- Would you consider yourself an emotional or logical person?

- How long have you been trading for and what type of strategy?

- Do you consider your self a patient person?

- How much time can you spend each day learning to trade?

- Are you able to follow strict rules and not deviate from them?

- What kind of personality do you have?

If you have questions about the competition please send me an email on cam at 52traders.com instead of leaving a comment 😉

Good luck!

Cam, thankyou so much. This is a great promotion on your part. I’m game for a mentor – I could really use one.

Would you consider yourself an emotional or logical person?

I am a logical person, but the emotion I struggle with most is fear of losing. FOMO isn’t my big problem. Rather, its more of paralysis by analysis, looking so hard for confirmation that by the time the trade is confirmed over and over, the entry is past and I don’t make the trade.

How long have you been trading for and what type of strategy? 2-3 years using intraday momentum strategies. I favor scalping strategies because I’m a surgeon by profession.

Do you consider your self a patient person? In some ways I am – I don’t give up easily and I’m a bit obsessive compulsive. I’ll keep with something until I have obtained my goal. But I also have no patience with poor performance.

How much time can you spend each day learning to trade? I have all day on Tuesday and several hours on the weekend. If I’m a student I can carve out time in the evening, or preferably at 0:Dark30 in the morning (Central time zone US )

Are you able to follow strict rules and not deviate from them? Yes. Especially when I have a mentor!

What kind of personality do you have?

Meyers-Briggs ISTJ.

I took the Tony Robbins DISC+ test recently, which essentially says that I am very competitive and bottom-line oriented with a strong preference for following established systems or creating them if none exist. In learning (or in this case being mentored) I am someone who seeks practicality and results, I want to know how the learning will apply in real-time situations, I learn by considering possibilities and thinking through ideas, I have high expectations of performance, and I process information actively. (I’m very quick).

In other words, my personality lends itself to being an ideal mentee.

Thanks for being the first Patrick! Good luck!!

Thanks Cam! I love the podcast and am excited about this contest, what an opportunity!

Would you consider yourself an emotional or logical person?

Yes…Mostly logical

How long have you been trading for and what type of strategy?

< 6 months and I'm still trying to find myself as a trader (i.e. trying different strategies)

Do you consider your self a patient person?

No

How much time can you spend each day learning to trade?

2 hours

Are you able to follow strict rules and not deviate from them?

Yes, my wife always describes me as a "rules person"

What kind of personality do you have?

Myers-Briggs ENTJ. In my day job I'm a nuclear engineer, some people say I fit the mold perfectly and others say I don't fit it at all.

Hi Cam,

Hope you are fine.

I love your show and this is again great effort from your side in helping newbies and struggling traders as you do all the times.

Really appreciate your efforts.

Below are the answer, could not brief much, little bit more than required details to give overview to my Mentors about my condition before considering me as an appropriate candidate.

My request to the Mentors, if they reject me; please show me some direction towards success through personal email or through your podcast.

I have joined few courses but I am keen to go for mentor-ship through your effort because:

It would be challenge for me as I am being highlighted and many people will wait to see the results. It will be a motivation by itself to avoid embarrassment of being failed to obey rules and be obedient to get success.

Normally we join mentor-ship and even if we fail and switch strategy, no one in world knows about our failure and we don’t discuss our weaknesses with friends of family.

This will be like a sword hanging on head to get success and be highlighted as a successful person as trader through competition.

Would you consider yourself an emotional or logical person?

I consider myself logical person but governed by emotions when trading comes to point. Right now I an suffering from Euphoria. I win couple of trades, try to get away from screen. Comes back next session with too much proud and then loose more than what I earned last session.

How long have you been trading for and what type of strategy?

I started learning and trading 2 years ago. Paid heavy amount for mentor but failed to get success due to A to Z reasons (Big list). Got sick of trading and failure in between and could not trade for 3-4 months but back with the studies and gaining confidence after listening all of your podcasts that success is possible, just need patience, perseverance and discipline, .

Now I am feeling better, started trading London Open and New York open with $1 per pip and still switching strategies one after another as all newbies do. I trade either using Moving Averages or Divergence or Contraction and Expansion strategies on 1min-5min-15min-30min and 1 hour charts.

I started trading on daily and 12 hourly charts but no more now.

Because I learnt all things (theoretically) including Candlesticks, Chart Patterns, moving Averages, Contraction and Expansion, Divergences, Elliot Wave, price and time circles and so on; So mind starts seeing multiple things at once.

Do you consider your self a patient person?

Normally we all feel that we are Patient. Now I can say that I was not a Patient Person till End of 2016 but now feel I am Patient and I have improved a lot since read the books of Tony Robinson and Dale Carnegie and applied the concepts in my day to day life. Especially the book Stop Worrying and start living by Dale Carnegie. My family, my staff has observed lots of changes in me. My kids are more happy spending time with me since start of the year 2017.

How much time can you spend each day learning to trade?

4 hours maximum per day. I am working full time in Australia so I can start any time of the day from London Open to New York closing.

Are you able to follow strict rules and not deviate from them?

Now I can say with confidence that I am able to follow strict rules and not deviate from them. Earlier I use to say but then deviate from just little hurdles but now learnt lot of lessons and after hearing your 74 episodes, I know there is no other way to get success in trading and I am determined to become a successful trader.

What kind of personality do you have?

Since I did the course of Tony Robbins and read the books of Dale Carnegie, I feel I am focused and dedicated person towards my goals. In learning I believe I am very humble and obedient student and I normally step over the edge( as described by Tony Robbins, ) If my Mentor says me to study 2 hours, I will study 3. That does not mean if my mentor asks me to trade $1 a pip and I will trade $2.

I am a quick learner however needs to read/ study / practice more than 3-4 times to get 100% clarity of the things. I feel I am too fast to jump over the things and I am controlling my speed for good so that I can walk before I run.

If I win, I will commit the time required by the mentor,

I will be available for interviews on the 52 Trades Podcast;

I will provide my picture;

I am happy to undertake hypnosis to help with my trading mindset; I know the value of hypnosis as I have started one for my health.

Keep on helping newbies Cam,

Your efforts are much appreciated and we all need it.

Kind regards,

Navdeep Singh

Hey Cam,

Love the podcast and the automatemytrading community!

Would you consider yourself an emotional or logical person?

I would consider myself logical but that does not mean that I don’t get a burst of emotion when winning or losing a trade

How long have you been trading for and what type of strategy?

I have been trading for 18 months. I have pretty much jumped from one thing to the next. Not so much trying to find the Holy Grail but instead finding something that works consistently. I have traded trend traded daily charts, used EAs purchased on the web, developed my own robots, and more recently scalped GJ using a mean reversion strategy. I have had some success with everything but as soon as something stops working I have started tinkering. I have been looking for a mentor that publishes their own results and practices what they preach. I have learnt the hard way that many make money from the wares but don’t trade themselves anymore.

Do you consider your self a patient person?

I am patient. I think that the fact that I am still actively studying the markets and working on my trading consistency is proof of that. I now need to be patient with one thing that works and stick with it.

How much time can you spend each day learning to trade?

8 hours a day. I currently have another business which I spend approximately 5 hours a week on.

Are you able to follow strict rules and not deviate from them?

Yes, if the reward is consistency

What kind of personality do you have?

I am an introvert. I love sport and being in nature. I enjoying working out and being around like minded people. I value experiences over material things but the thing that I value most and keeps me on this journey of discovery is my wife and two young children. I am determined to be a successful trader and won’t stop developing myself and my understanding of the markets

Hey Cam

Looks like 52 Traders is going from strength to strength! Great news that the EA is doing so well despite the bump in the road with the weekend gap.

Don’t usually enter competitions but this is just too tempting 🙂 My answers to the questions are below.

Would you consider yourself an emotional or logical person?

I am more logical but see some some strong empotional aspects I have had to logically look at within myself.

How long have you been trading for and what type of strategy?

Approx 6 months, Scalping and Intraday.

Do you consider your self a patient person?

Yes in some things but not when I am seeing lots of drawdown, I prefer to go with momentum and go into profit or have a tight SL. Patience when waiting for the trade is not a problem, patience in the trade is what I am improving I hope every day.

How much time can you spend each day learning to trade?

All day this is what I have dedicated my time to make it as a full time trader.

Are you able to follow strict rules and not deviate from them?

Yes I actually like strict rules as it removes all the noise and makes the trading more robotic.

What kind of personality do you have? I am a libran so I am balanced. I analyse and go deeply into all subjects I am interested in. Often at the expense of profit. I like clear rules and like to funnel my self into a decision process meaning even if i loose the trade but follow plan then it still a good day.

Hi Cam,

I stumbled across your website very recently and have found the content to be of great interest for any trader wanting to progress. Hearing the journeys other traders have taken, creates a greater sense of passion and drive through seeing others that are doing it or have done this and succeeded. Also what keeps this honest and engaging is the fact you are going through the same journey, same obstacles and trying to conquer these to succeed. Answered questions as below, and funny you should mention hypnosis i was looking into NLP myself as another enabler toward success.

Would you consider yourself an emotional or logical person?

I think i consider myself to be a bit of both, but now am realizing more that emotions can have a negative impact on trading as this leads to other spiraling issues (such as revenge trading, over trading, making same mistakes repeatedly such as moving your stops). I am trying to incorporate logic into my trading based on systems, and also understanding how psychology factors into trading.

How long have you been trading for and what type of strategy?

I have been trading for around 2 years on and off, and only in the last 5 months starting to follow systems. I trade indices mostly. I’m still learning the systems, I do like momentum strategies, or reversals off key areas. Scalping mostly at the moment as it has been a very low ATR environment.

Do you consider yourself a patient person?

Psychologically i was impatient as i wanted results right away when i first started trading, especially of the back of decent wins. I have very quickly learned that it is better to approach trading with wanting to learn, and then the rewards will come as a result of this. However, i would still want to see myself as being results orientated once i have the learning in place. I would like to be a brick layer, if something works repeat over and if you need to deviate then build this into the new rules/plan for that system.

How much time can you spend each day learning to trade?

I currently do this full time as work was not allowing me to progress in this further, so i can spend time as required to further my knowledge. I trade London time, so can commit during these hours and more as required.

Are you able to follow strict rules and not deviate from them?

I am able to follow rules, i like trading systems as over time this approach works better than randomly trading a view.

What kind of personality do you have?

I think i able to deal with stressful situations, not to say that i am complacent. I am not risk averse, but at the same time i don’t like losing unless its within the risk profile of what i am trying to achieve (learning the hard way by making mistakes, and understanding why). I am driven, wanting to succeed and see this as a journey rather than a quick fix.

Cheers

Nilesh

Hey Cam,

Discovered your pod after hearing your interview on Rob Booker’s podcast and what a awesome discovery it has been! I’ve listened to more than half of the episodes since then and at this pace I’ll have listened to them all within the next couple of months. Thanks for all you do!!

Here are my answers for the contest.

1. I lean more to the emotional side with a logical voice deep inside that tries its best to keep the emotions under control.

2. I’ve been trading for about 10 months using strategies based mostly on trend following and momentum. I’ve gone mostly off the hourly charts while using the 5min to help with entries. I would say they are mostly day trades while some could be considered swing. Sometimes my trades are open and closed within an hour or two while others can stretch up to 2 days if my targets aren’t hit. It’s a high risk to reward with a high win rate and I’ve pretty much have been at break even since I started.

3. The strategy I use has taught me to be a more patient person, especially on the trades that last longer then I’d like. I’ve also learned to be more patient over the long term and not get caught up in over trading which has burned me in the past.

4. For my regular job, I work overnights in a hospital here in Iowa and I tend to get quite a bit of downtime which I devote completely to learning and trading. I would say on average I spend anywhere from 2-5 hours each trading day to looking at charts/backtesting/reading and trading.

5. I’m not perfect, but I’m getting better each day of following the rules to the system I use. The times I’ve deviated, I of course have taken it to the chin. In fact I’d probably be a profitable trader right now if I hadn’t thought I was more clever then or afraid of the system. I’ve started a new technique of staring at the back tested results of the system each time I feel the urge to change it or jump ship. Happy to say over the last 3 weeks I’ve been on the straight and narrow and have had a very profitable stretch.

6. I’m a very even keeled and easy going type of guy who can get along with almost anyone. I love to read and learn and I’ve been fascinated with all the financial markets since my college days.

Again, thanks for all you do Cam. If my only win is getting to continue to listen to the show, I’ll be a happy man and trader.

Hello Cam,

What an amazing opportunity you are offering here. I have been listening to your podcast for about 6 months now and haven’t stopped. Thanks for all you do.

• Would you consider yourself an emotional or logical person?

I would consider myself a logical person. Due to my engineering background most choices I make on a day to day basis for work are based on logic which in turn flows into all aspects of my life.

• How long have you been trading for and what type of strategy?

I have been trading on and off for about 3 years. I started with a divergence trading strategy and more recently have been looking into mean reversion trading. At this point I am doing more research than trading.

• Do you consider yourself a patient person?

I definitely consider myself a patient person. I have been learning and reading about trading patiently waiting for it all to come together.

• How much time can you spend each day learning to trade?

I have a full-time job from 8AM to 5PM 5 days a week. Outside of those hours I am willing to devote any hours necessary to master my potential mentor’s program.

• Are you able to follow strict rules and not deviate from them?

Absolutely. As mentioned earlier I have an engineering background which means I am more inclined to follow strict rules which is what I prefer.

• What kind of personality do you have?

I consider myself to be a happy person that doesn’t stress out on many things. I enjoy learning new things and meeting new people.

Thanks again Cam! Looking forward to your next episode.

Wow. When I heard about your competition I thought; oh wow! – a 99% guaranteed opportunity to finally become profitable! And right on the heels of that was: Heck! What if I win? Trepidation! I’d have to get real, wouldn’t I? lol…

I don’t know if I should include that truth in my reply… but anyway, to the answers.

Although I’m more of an emotional person I manage my emotions well and look for logic in decision-making.

I started learning with a Day Trading company in October 2015. I went live a year later… and have, so far, bust 3 accounts back to margin… small accounts to be sure in the larger scheme of things (all under $1000) but big for me. All 3 busts were solely my own doing, making all the beginner errors. I’m now very grateful for this however, as I have learned from experience the reasons behind certain tenets and rules and now that they make gut-sense to me I have no problem applying them rigorously! (Using stop-losses and never moving those; allowing the price to either reach my initial target of 2:1 or take me out; being ‘happy’ with losing trades as those are simply part of the process; understanding that trading is a ‘numbers game’; etc.)

I trained on the S&P e-mini and have come to love trading futures; I now demo trade the e-mini NQ because of the lower cost-implications. I use Ninja to analyse but enter orders on the free MultiCharts (I have an account with AMPFutures). I use several strategies, mainly based on retraces / pullbacks using Fibonacci levels. My longest trade lasted 2 hours and that was a stretch for me as I’m more naturally a scalper. I would hate to go to sleep with an open trade…

Do I consider myself to be patient? Hmmm, tough one. Yes and no; it depends on the context. I am persistent however, and have been called ‘stubborn’ and ‘dogged’, lol. For instance, I’ve been ‘advised’ to give up on my belief that I can be a consistently successful trader because, amongst other things (a) I have insufficient capital and (b) 95% of traders fail and what makes me think that I am going to be any different and (c) I’ve lost money already and … you get the picture. Yet I’m still here and plan to be until I am profitable – because I can be, I know this without a shadow of a doubt. There’s an element of necessity here too as I am wheel-chair-bound and rapidly approaching an end of my private benefit fund so I need to put an alternative in place. Trading is an ideal occupation for me because, well – I love trading!

I can sensibly spend at least 8 hours a day in trading-related stuff before I need a break.

If I can understand and accept the reasons behind rules I can follow them without exception. And if they’re told to me by a proven successful mentor – well, that speaks for itself, doesn’t it? He/she has found success using those rules therefore they are valid – period! So the answer to this question is an unqualified “Yes”.

I just did a couple of online Personality tests including 6 different versions of the Myers-Briggs and got ENFP 4 times, and INTP once; and on the Helen Fisher page I’m a tie between Director and Negotiator… some of my values are fairness, tolerance, compassion, humour, industriousness… and not shy, lol!

I love your end observation regarding stating stuff in a positive way – so true! Tell a person: Don’t drop that plate and the brain must make a picture of dropping said plate in order to understand your exhortation and – bingo! The likelihood is that of a dropped plate… but tell a person: Carry that carefully now and well: you get the picture! And so does the person – the desired picture. I trained a little in NLP – it’s an awesome process. I also completed the basic training as an Ericksonian Hypnotherapist so I’m very predisposed to all this

Hmmm. Well so even if I do not end up being one of ‘the Chosen Ones’ (which I desperately hope I do!) this has been a valuable exercise in and of itself – thank you!

And most importantly, Cam, thank you for your willingness to go the extra mile for all us traders ‘out here’ – you are valued and appreciated 🙂

Thanks everyone, great to read all the entries and hear your struggles. Keep em comin!

Hi Cam,

* Would you consider yourself an emotional or logical person?

> I believe everyone has a mix of emotion and logic. I lean to the Logical side and I am continuously working to improve my emotional side

* How long have you been trading for and what type of strategy?

> For the past 12 months I have been trading an intraday scalping strategy in the the futures market

* Do you consider your self a patient person?

> I am not a particularly patient person but find my inner patience with trading 🙂

* How much time can you spend each day learning to trade?

> As much time as required currently I learn or trade for approx 6 hours per day

* Are you able to follow strict rules and not deviate from them?

> No I am not a saint … I am human so I do slip up from time to time but part of my process includes trade reviews and appropriate actions to help me address these issues as they arise.

* What kind of personality do you have?

> I am coachable and open to new ideas. I have a passion for learning to trade, the desire and belief that I can become a better and more successful trader.

* Would you consider yourself an emotional or logical person?

> 70% emotional /

* How long have you been trading for and what type of strategy?

> 16 months, “I keep surging strategy” 🙂

* Do you consider your self a patient person?

> Not really

* How much time can you spend each day learning to trade?

> 2 – 3 hours a day

* Are you able to follow strict rules and not deviate from them?

> In the end I think I can but I expect to stay human and make mistakes once in a while

* What kind of personality do you have?

> Determined, competitive, impatient at times, decisive, manageable

• Would you consider yourself an emotional or logical person?

Ha. Great question. I honestly use both sides. My natural state rests in the emotional domain, however I always I rarely act without thinking about the logical aspects as well.

• How long have you been trading for and what type of strategy?

I have been trading for 7 years (casually) using a mix of automated and manual techniques. I’ve tried scalping, trend following, pattern recognition to name a few. Conceptually the concepts are familiar and I understand the theory. Execution and results are another question. I’m still here, still learning and haven’t given up.

• Do you consider your self a patient person?

Naturally, no. I have and continue to teach myself this art…..my job as a fighter pilot has taught me discipline to work on weaknesses, and I meditate daily as well as have undergone hypnosis for many other work related activities.

• How much time can you spend each day learning to trade?

Currently I spend 1-2 hours. Could do 2-4 depending on what day of the week it is.

• Are you able to follow strict rules and not deviate from them?

Without question….refer to Q3. That parts easy…its just finding rules that work.

• What kind of personality do you have?

I absolutely hate to lose – Hyper competitive (good and bad really!).

Hi Cam. Thanks for the great opportunity.

Q1. Would you consider yourself an emotional or logical person?

Logical. However being brutally honest I’m both. Its about managing the emotions and looking at things in a certain way. In trading terms that means acknowledging that every trade has an uncertain outcome.Since I reduced my position sizing I’ve become a lot less emotional about my trades. When things are going well I don’t get too excited. When things are not going so well I don’t get too down.

Q2. How long have you been trading for and what type of strategy?

14 months. The strategy is a work in progress. You never stop learning. I’m always working on my trading plan. I try to do more of what works and less of what does not work. As I knew next to nothing about trading I did a trading course that was mostly about fundamentals. Since then I’ve realised that finding a style that suits your personality is essential. Now I’m mostly technical. I truly believe “the tape tells all.” I guess I’m in the trend following category.

My strategy now is to go long stocks above the 200 day MA (in outperforming sectors) that pullback in an uptrend and go short stocks under the 200 day MA in (under-performing sectors) that retrace in a downtrend.

I monitor the Forex markets but I have not traded it yet. Its something I want to do.

Q3. Do you consider your self a patient person?

Yes. My wife might disagree! I guess I am but only as long as I can control the chimp (The Chimp Paradox) inside of me! Removing emotions as much as possible is the key to patience.

Q4. How much time can you spend each day learning to trade?

As much as is possible. I’m a stay at home Dad so whenever I get the opportunity! Most of my work is done when the kids go to bed.

Q5. Are you able to follow strict rules and not deviate from them?

Yes. I think I’m pretty disciplined. I was a teacher for 8 years in a school where discipline (and humour) was essential to survive! Another aspect that helps my discipline is fitness and nutrition. I believe discipline must be practiced through all aspects of your life. I recently read that the turtle traders who succeeded were the ones who most diligently implemented the rules- says it all.

Q6. What kind of personality do you have?

I do find this a difficult question to answer. I think I can get along with most people! I think I’m quite a calm person. I like to keep things simple. My main interests are trading, football (Manchester United!),golf, coffee & red wine! I like reading books that can actually benefit you. My favourite trading book is Trading in the Zone. The best book I’ve read recently was Shoe Dog. The author I admire the most is the incredibly smart Nassim Taleb.

Thanks for the opportunity. If successful I would be a very grateful mentee.

Best wishes

Brian Brady

Wow, how to start? And this is a public forum. So much for being shy…

Would you consider yourself an emotional or logical person?

Very difficult question for one person to analyse of oneself! I am by training; logical. And I am by nature; emotional. But then again, who is not? So, to answer this in terms of a frame of reference, and using that frame of reference as trading, I am going to say 80% emotional. Because, once money is involved, one cannot help but to become dominantly emotional. That is the training I am thinking I need to manage my expectations correctly. Hence, the move toward using “robots” (see below) to act on my behalf.

How long have you been trading for and what type of strategy?

I have tried trading back in university and sometime slightly after when we tried to download all the stock market data (we could get our hands on) into excel and create charts to analyse. That ended in an emotional wreck. Now, some 25 years on, and i am researching the wealth of knowledge in Cam’s data base. I am trying to trade “discretionally” on a trend following swing system. Equally, I am trying to trade a robotic system on a counter trend strategy using RSI and divergence.

Do you consider your self a patient person?

With my wife and family I am an extremely patient person. (Otherwise I would not have that very same wife). With my trading, I want to see results. That makes me slightly impatient. But i do respect that it will take time to learn, and more time to perfect. The short answer Y-E-S, but that is a qualified Y-E-S.

How much time can you spend each day learning to trade?

I take to heart what Cam’s self reflection said. Time to learn to trade, or time to learn how to automate a system. I have equal time for each. The time to learn to trade would equal my goal to keep the ageing process at bay. The time that I would like to research and program a system would be equal. I would estimate that to be an aggregate time of between 2 and 4 hours per day.

Are you able to follow strict rules and not deviate from them?

Well, I consider this crucial to the success. A system is only as good as one is good to “stick-to-that” system!

What kind of personality do you have?

Wow, how can I answer that in a “comment”?

Let me start by saying “purple”.

Love winning, don’t stop if I am losing, realise the extent of my talents. So, I will not try to beat Nadal on clay, nor Stenmark in a slalom, but will bet myself on odds that I can place.

Would you consider yourself an emotional or logical person?

I don’t know if that’s a fair dichotomy, it’s like separating art from engineering. I try to think of emotion as part of an objective decision.

How long have you been trading for and what type of strategy?

I’ve had brokerage accounts open for a bit over a year, it’s mostly been buy and hold investments so far. I’ve been researching more for the past few months now that I have a career and steady income. I’d like to develop a swing trading strategy once I study the markets enough to understand a bit of what’s under the hood.

Do you consider your self a patient person?

I do, I enjoy the reward of a long term effort. Understanding is more important to me than outcomes, and that comes with time and experience.

How much time can you spend each day learning to trade?

A few hours most evenings is doable, I run and climb a decent amount but otherwise spend most of my time reading.

Are you able to follow strict rules and not deviate from them?

Yes, especially if I can understand and respect the underlying principles.

What kind of personality do you have?

A bit addictive, a bit eccentric. I’m fairly quiet unless on a topic I’m knowledgeable about. I enjoy designing and building systems, especially sustainable ones. I hand built the bicycle I commute on, and am currently building an aquaponics system.

Hello Cam and Mentors:

When it comes to trading, I consider myself unfortunately an emotional trader. Which has caused me to hold onto trades longer than I should have or avoided getting into trades I should have taken. As the saying goes…Hindsight is 20/20.

My journey into trading started 10 months ago using a signal service for the Nadex Markets of Gold, Crude, US 500, Forex. In the hopes to start learning to trade while I traded. In November of 2016 I quickly blew my account and canceled the service. My reasoning for canceling was simply the insanity of me paying someone to lose my money, when it was easy enough for me to do it myself.

Since then I have been reading and using my demo account to work on learning to use Pivot Point Analysis and the basics of Ichimoku Cloud. My current strategy… I don’t have one. I know that I need to take the time to learn a system that I can stick with and not deviate from that system. That is what lead me to read up on the Ichimoku Cloud, it has rules for entry and exiting. I am nowhere near learning it and to be quite honest, I’m overwhelmed with all of the ins and outs of that system.

When it comes to patience, being a parent to a toddler has honed this skill in me. Some days are better than others, but I keep on keepin’ on.

I can honestly commit to 4 hours of learning, two hours early in the morning and two more in the late evening (PST). But for a such a great opportunity I will do what needs to be done to work with a mentor.

When it comes to following rules and not deviating from them; I’ve gotten better at this.

If I was good at following rules in the first place, I would have never tried trading.

Based on my results from personality tests; I have a Logician Personality (INTP-T).

80% Introverted, 77% Intuitive, 73% Thinking, 75% Prospecting and 55% Turbulent.

I’m looking forward to hearing the outcome of everyone that gets the opportunity of mentorship.

Thank you for everything that you have shared on your Podcasts, they are both educational and entertaining.

Regards,

Katherine Meyer

Hey there Cam,

I would consider myself to be a logical person, head definitely over heart. I am normally quite good at cutting my loses and getting out.

I haven’t been trading long. Maybe six months in total. I’ve been using etoro a bit just to copy successful traders and to see what they do before diving in myself. I’ve made a steady profit so far. Nothing huge, but not bad. I’ve done a few trades too, mostly currencies, but based on news events rather than charts. I am a news addict.

I would consider myself a patient person yes. I think I am quite level-headed in general. I am a Brit living in Spain so I’ve got used to the mañana mañana approach to life. Everything here is much slower than back home so you learn patience.

I have a self-service laundry which means that I only work when the laundry is down or there are repairs that need to be done. Therefore I can commit to however many hours I need to.

I used to work in yachting and I was the first mate on a 30 metre super-yacht, so you have to take orders from the captain and not deviate from the rules or people’s lives can be at risk, so I’d say yes, I can stick to rules quite well.

That’s a hard one, evaluating yourself. I’d say that I am not an extrovert, I enjoy my friends very much, but also my own company and being with the dog. I spend time at home during the day so I am quite self contented. I enjoy life, especially the simple things like the sun or a nice view. I’d like to think of myself as quite intellectual. I love reading factual books, especially history and politics. I love a joke. I’d say that I am overall quite a pragmatic person and I always try to look at the positive.

Q: Would you consider yourself an emotional or logical person?

A: Logical person until i start losing money!

Q: How long have you been trading for and what type of strategy?

A: Jumping around and have done from day trader to EOD trading. Few years in total, what I have at the end of the day now is ‘directionless’.

Q: Do you consider your self a patient person?

A: Yes, I am. BUT, waiting for entries when day trading can REALLY test my patience.

Q: How much time can you spend each day learning to trade?

A: For the next one month, 24/7. If I can’t make good money within the next one month, then probably 2-4 hours a day. I.e., back to office job as I am currently unemployed.

Q: Are you able to follow strict rules and not deviate from them?

A: Yes, this I am quite sure. Now, I just need a profitable trading plan that is super clear and makes high return per month. 🙂 🙂 🙂

Q: What kind of personality do you have?

A: Optimistic I guess – since I have paid quite some money in this aspect and been conned/disappointed more than once.

Hello Cam and ” Futures Mentors ”

Would you consider yourself an emotional or logical person?

I completely consider myself as a logical person in general aspects of life, about trading I would say at moment is 80%logical and 20% sentimental, this all together with a poor risk management in my case is the key for blow accounts, my sentiments.

How long have you been trading for and what type of strategy?

Been trade for 2 years, actually reading and focus in the theory and how everything works,

if I don’t know what Im into it how can I be successful, got some good books in the shelf, start trade “or at least try to” a year ago with demo accounts and couple of lives, I have tried many strategies and so far the ones that “work” for me is crossover 200 EMA, 50 SMA, Parabolic SA and always price action, big fan of Candle Sticks pattern. Timeframe Im using the 3 screen strategy which start for me from 1w, 1D, 4H chart.

Do you consider your self a patient person?

Yes, very much, I really don’t have this problems with that in my trades, what I got is the lack of confidence in my strategy which make me close my trades too soon or too late.

How much time can you spend each day learning to trade?

Around 3 to 4 hours more or less.

Are you able to follow strict rules and not deviate from them?

Yes been in the Army for 2 years so I guess Im pretty good in follow rules, deft of knowledge make me deviate from my trade path.

What kind of personality do you have?

Im a surfer, so Im a calm person who really appreciate spend time with my family, and basically cracking my head into trade to try don’t give 40 hours of my week for someone else instead of be with wife kids and dogs.

For more information PLEASE contact me.

Danilo Nolasco

Hi Cam, I started listening to your podcasts not long ago. Am currently catching up and loving it. Up to podcast 59 currently.

I have been trading for a few years now but can’t seem to break through. I struggle sticking to 1 strategy and quickly move onto the next and have been doing this since I started. So I have been trying to come up with a trading plan but have problems figuring out exactly how and what I need to complete this.

I have been developing a few EA’s which seem to work for a period but then they don’t. I can’t seem to work out the Market type and when a pair moves to a new market type etc.

I seem to have enough knowledge in Forex (or so I think), I just need someone to put it all pieces of my puzzle together for me.

Would you consider yourself an emotional or logical person?

Very emotional when it comes to trading.

How long have you been trading for and what type of strategy?

10 years. Mixture of different types.

Do you consider your self a patient person?

Depends on the situation. If I know the outcome will be great then yes.

How much time can you spend each day learning to trade?

3-4 hours

Are you able to follow strict rules and not deviate from them?

Yes, a great example was when I was training for a marathon I had a strict schedule for training for 8 months prior 4 days a week. I did not miss 1 training session.

What kind of personality do you have?

Active, want to be on the move.

Keep up the good work.

Daniel

Hello Cam,

Japie is a AMT member and I am Petro, his wife. We both trade. Started many years ago, quit and took it up again about 3 years ago. Serious this time.

So this is my entry for your competition. (Without the hypnoses, please.)

My answers:

A1. As a woman, very logical.

A2. 4 Years FX experience. Started with a paid course, followed a signal service for a period and followed a few free mentor’s service, mostly long term strategies, reversals on S&R levels. Currently doing/testing Ivo’s (from the Podcast) strategy.

A3. Patient yes.

A4. Around 5 hrs per day, prime time. Can do more should it be required.

A5. Yes. Can and will do things dutifully. Proofed that I can follow a strategy, without jumping around. Have not yet blew an live trading account.

A6. Easy going. Disciplined in healthy lifestyle, religion, family life etc. Cautious in unknown territory.

Hello Cam,

First off all thank you for the excellent podcast with great contents and also thanks for giving this opportunities for the listeners to be trained by successful traders . You are rocking buddy 🙂

Now here is my answers to your questions

-Would you consider yourself an emotional or logical person?

In trading I consider myself an logical person and I am firm believer of law of large numbers

-How long have you been trading for and what type of strategy?

I have been learning to trade more than 4 years , testing different strategies from technical to fundamental , now purely using technical on both manual and automated trading .

-Do you consider your self a patient person?

Yes , I am.

-How much time can you spend each day learning to trade?

6-10 hours / day, currently most of my time is spend on learning to trade .

-Are you able to follow strict rules and not deviate from them?

Yes , I can

-What kind of personality do you have?

easy going and optimistic.

Hi Cam

Thank you for providing listeners with an amazing opportunity to learn trading. Here I am registering my interest by providing below answers.

1) My approach in all aspects of my life is very scientific. Though at times I became emotional with my trading, I consider myself very logical.

2) I am actively trading since March 2015. Currently I am trading pure price action using support and resistance levels. I averages 10 trades per day.

3) I am becoming very patient with my trading.

4) I can spend 6 hours a day learning to trade. I can spare time for Full London session and Half US sessions everyday.

5) I am constantly struggling to follow my own created rules. Part of the reason is I am not getting any consistent success. My approach is very systematic and Yes I can follow strict rules if provided by mentors.

6 ) I am a simple living person with very high thinking. I Love nature – my life – and the puzzles life gives in everyday living. I have many interest in life and I do follow some of them regularly. I do play sports – mediate and exercise/yoga daily, spend time with nature grow plants. My flexible work environment since last one year has provided me an ample amount of time for me to use for my life and I am using this time to shape my future.

Dave Kalpesh

Perth Australia

Hi Dave, I’m from Perth too. How do I get in touch with you?

Hi Daniel

Good to know someone with same interest.

Please email me your contact on payrollprocessed@gmail.com

I dont want to list my cell here. I willl call you. I live in Brookdale (past Armadale)

Working in finance in a company in Burswood.

Cheers

Dave

No way. I’m in Bedfordale. 🙂

Loving the entries guys!! Pilots, Surfers, Military, Housewives and Nuclear engineer’s… what a great selection of contestants!

Yes! This is exactly what I think I need to finally get on track with trading!

So far I have strictly adhered to a system of multiple small wins followed by a few large losses…i.e. cut your winners fast and hang on to the losers until you can’t bear the pain anymore!

I have been interested in trading since reading about the turtles some 25 years ago and wishing that similar training/mentorship was available….but there is no easy way to filter out all of the rubbish from the good training and strategies that must be available somewhere!

I have taken heart from Cams’ podcasts – hearing the stories of multiple successful traders proves to me that there are teachable and repeatable strategies available- and the opportunity to be mentored by one of these successful traders is awesome.

I am certainly able to follow rules, with a career in aviation including military navigation, air traffic control and airline flight planning, but until now I have not been able to find the traders rule-book!

I live in New Zealand and work shifts so have plenty of time available to dedicate to training. I am a logical/mathematical thinker and not overly emotional when it comes to money or trading.

I have not been able to narrow down my ideal style of trading yet- in the past I would have said more of a swing trading mentality, but lately the podcasts from Damon Aleczander, Avdo Hadziavdic and Derek VanDelinder have got me paying a lot more attention to scalping!

Regardless of the trading style, please throw my name into the mix for consideration to become one of the mentees- I’m sure it would be life-changing!

Thanks!

Hi Cam and mentors,

Please find the answers to your questions below. I think a mentor would be a great benefit for me. I have been wandering, lost for a long time. Maybe bamboozled by all the (mis)information that’s strewn across the internet. Already in this past month or so being part of Cam’s group I have made progress and am starting to see signs of success. To add a true mentor program on top of that could only be of benefit and I would be happy to share it with others so they can believe that success is possible, even for us “middle class fools”.

Cheers

• Would you consider yourself an emotional or logical person?

That’s a hard one. If I take action according to my rules or principles but chew my fingernails off while I wait to reach the next point of action am I emotional or logical…? I think the emotional (mostly anxious) side of me is often due to having no belief in myself and the decisions my logical self is making. So I guess as much as I’m trying to be logical, there is still internal, emotional turmoil. In the context of trading, I make decisions according to whatever system I am using at the time and I can do that even when my intuition (emotions?) is screaming at me to do something.

• How long have you been trading for and what type of strategy?

On and off for several years in forex specifically. Unfortunately the best I have done is break even using price action back in 2014. Due to my personal situation at the time I gave trading away (again). This time back (Jan. 2017), I have not settled on a strategy at this time. I started using one of Rob Booker’s EAs but that ended in disaster. I would say that was pretty much my fault for believing in someone else too heavily. Since then I found Cam’s course and I’m currently building EA’s and testing various strategies I find strewn across the internet, mostly without success. It’s amazing how converting someones strategy into robotic terms really brings the truth to the surface… Or I’m just sh!t at building EAs which is just as likely!

• Do you consider your self a patient person?

I’d like to say yes; maybe in my mind I am but the truth is no, no I’m not. I often edge towards “analysis paralysis” to a point where I end up just jumping in and following one decision, often to my detriment. I think this has a lot to do with my inability to trade with discretion as I often vacillate too much and miss the opportunity or I make a decision hastily only to realise afterwards the rest of the things I missed which would’ve validated or voided the trade. It’s why checklists are good for me and even more so EAs that make the decisions for me. Then I just need to NOT look!

• How much time can you spend each day learning to trade?

Being a father and husband most weekly I am available from about 8PM to 11PM (GMT+8). Wednesday nights it’s more like 9PM. Weekends are usually the same time but can be variable due to social commitments. It’s a good time for me to do longer tests as I can simply turn it on during the and go do chores, play with kids etc while it runs.

• Are you able to follow strict rules and not deviate from them?

Now, for all my lack of patience and indecision, ironically, following rules is something I can do quite easily! Even more so when there is accountability.

• What kind of personality do you have?

I am probably anxious and very much introverted. I am quite happy with my own company and find it difficult at parties and the like because of lack of confidence. That said, when I’m with people I know and I’m comfortable I can talk and be quite confident. I am loyal and trustworthy and strive to act with a high level of integrity. Where that fails is I tend to expect the same of others and am frequently disappointed because of my own lofty standards.

Cam, thank you so much for providing this opportunity for your listeners. This will likely positively change the life of the 3 people selected.

Q1. Would you consider yourself an emotional or logical person?

A1. When it comes to life in general, I am very logical, but like most traders starting out, I had periods of being emotional when you have your own money on the line. I’ve revenge traded, got mad at myself, the market, closed trades 1 pip from stopping me out only to see them hit my target, etc. Over the past 4 months (almost 60 trades), I have been solid at not letting emotions get in the way and trading solely based on my plan and rules.

Q2. How long have you been trading for and what type of strategy?

A2. I have been trading for 5 years. My strategy is based on pure price action and supply and demand levels. I do not have indicators on my charts. I tried scalping and am now more of a daytrader where my trades can last up to 1-2 days. I plan my trades, set my trades in advance and let them work with some stop management in place after a first target has been reached. Since I started trading I have been experiencing the new trader characteristics of: not following rules, trading sim, seeing some success, going live, hitting drawdown and then back to sim on another method. It has taken me up until the last 4 months to finally be able to create a plan, trade the plan exactly as it’s written down no matter what the outcome of each trade is. But even with following my rules for almost 60 trades, I am still a breakeven trader. Reviewing my trade log does not show any one thing that would turn me profitable. I started out trading Forex, but have been focused on futures; however, I will open a Forex account to trade with if I am lucky enough to win.

Q3. Do you consider your self a patient person?

A3. Honestly, I like instance gratification in life, but do not believe that I must be a scalper. I have found that I am very patient with open trades as long as I have locked in a profit while letting the remainder of the position play out. My preferred method would be a set-and-forget (with management), but due to my current lack of success am open to new things.

Q4. How much time can you spend each day learning to trade?

A4. I am typically at my charts at 6:30am until 10:30am Eastern/New York time. Some days I can be available until 11:00am and some days I have to leave by 9:00am. I have a flexible work schedule, but do have some regular meetings I must attend. I also have approximately 2 hours in the evening (9:00pm to 11:00pm) to dedicate to learning/trading as well as several hours on the weekends.

Q5. Are you able to follow strict rules and not deviate from them?

A5. Yes! I always knew it was vital to a trader’s success, but it has taken me years to finally be able to consistently follow a set of rules and I cannot believe how much calmer I am when the trade is pending, hits target(s) or is even stopped out.

Q6. What kind of personality do you have?

A6. My personality is more introverted and very humbling. I do not get cocky, arrogant or brag about things just to make me look better than someone else. In a crowd, I prefer to sit back and watch people than be the center of attention, but can step up and lead projects at work/home when I have to. I tend to learn better when it’s a one-on-one environment. This is why I am very interested in this opportunity for mentorship. The previous courses I purchased have all been one instructor to many students and I find it very difficult to get questions answered or help in general. I interact much better when I can talk to someone personally.

Thanks,

Kevin

Hi Cam,

I love your podcast, found it about 5 weeks ago and I listen all the episodes I’m @ episode 65. I listen some twice or more… Please keep up this good work, and never forget: what you give is what you get… i wish you all the best.

So first of all my journey with trading is a bit hectic… If someone can turn me a successful trader, I think need to wake up early and work hard… 🙂 I couldn’t figure out how I like to trade try to find what is match with my personality. Anyway if I going to be the one who is chosen I give 110% and whatever is take to get to the point where I can say I’m arrive or fail… either way is acceptable for me because trading is not for everyone…

Please find below my answers

Please answer these questions (from my mentors) in your comment:

Q1; Would you consider yourself an emotional or logical person?

A1; If the question is trading related I’m logical because it’s pure business. But in the family side I’m really emotional.

Q2; How long have you been trading for and what type of strategy?

A2; Started 3 months ago to self educate myself, because I want to get out of this modern slavery. The strategy what I try to follow and use is a 3period EMA crosses a 13 or 21 period EMA, for trend following I have a 50 and 200MA. Checking higher timeframes for trend direction and 5 min chart for get in and out. on indicator side I like RSI and Stochastic but I prefer RSI default settings or sometimes I put a 2 period over a 12 period. I start to research the On Balance Volume, try to see the singularity between the price and the OBV, because whatever you do you can’t miss if you follow the smart money.

Q3; Do you consider your self a patient person?

A3; NO, and this is my biggest challenge with myself, and this is why I try to trade the 5 min chart, the others are a bit boring at the moment.

Q4; How much time can you spend each day learning to trade?

A4; I’m working to a weekend day shift Fri-Sat-Sun 6am-7pm but never finish before 9pm. Monday to Thursday I’m quite free just with the kids or learn and research the Forex and try to figure out what I’m doing good and bad.

Q5; Are you able to follow strict rules and not deviate from them?

A5; ABSOLUTELY, if someone tell me what I need to do to be successful and how to trade why should I not follow the rules?

Q6; What kind of personality do you have?

A6; If I start something I not give up until I get where I want to be. I like jokes, and I have a sarcastic humour, gag others if I’m bored. Others said I’m a character, don’t know is that good or not… 🙂 On the other side, I’m working in the F1 business, programming 5 axis CNC milling machine what is can be really stressful. Out of work I responsible for my family and my kids, so everything what is connected to them and their future I’m 100% serious.

After all, my mother language is not english. But I don’t think this is going to be a problem.

Thanks for all your hard work and thanks for this opportunity.

Max

Hi Cam,

I love your podcast, found it about 5 weeks ago and I listen all the episodes I’m @ episode 65. I listen some twice or more… Please keep up this good work, and never forget: what you give is what you get… i wish you all the best.

So first of all my journey with trading is a bit hectic… If someone can turn me a successful trader, I think need to wake up early and work hard… 🙂 I couldn’t figure out how I like to trade try to find what is match with my personality. Anyway if I going to be the one who is chosen I give 110% and whatever is take to get to the point where I can say I’m arrive or fail… either way is acceptable for me because trading is not for everyone…

Please find below my answers

Please answer these questions (from my mentors) in your comment:

Q1; Would you consider yourself an emotional or logical person?

A1; If the question is trading related I’m logical because it’s pure business. But in the family side I’m really emotional.

Q2; How long have you been trading for and what type of strategy?

A2; Started 3 months ago to self educate myself, because I want to get out of this modern slavery. The strategy what I try to follow and use is a 3period EMA crosses a 13 or 21 period EMA, for trend following I have a 50 and 200MA. Checking higher timeframes for trend direction and 5 min chart for get in and out. on indicator side I like RSI and Stochastic but I prefer RSI default settings or sometimes I put a 2 period over a 12 period. I start to research the On Balance Volume, try to see the singularity between the price and the OBV, because whatever you do you can’t miss if you follow the smart money.

Q3; Do you consider your self a patient person?

A3; NO, and this is my biggest challenge with myself, and this is why I try to trade the 5 min chart, the others are a bit boring at the moment.

Q4; How much time can you spend each day learning to trade?

A4; I’m working to a weekend day shift Fri-Sat-Sun 6am-7pm but never finish before 9pm. Monday to Thursday I’m quite free just with the kids or learn and research the Forex and try to figure out what I’m doing good and bad.

Q5; Are you able to follow strict rules and not deviate from them?

A5; ABSOLUTELY, if someone tell me what I need to do to be successful and how to trade why should I not follow the rules?

Q6; What kind of personality do you have?

A6; If I start something I not give up until I get where I want to be. I like jokes, and I have a sarcastic humour, gag others if I’m bored. Others said I’m a character, don’t know is that good or not… 🙂 On the other side, I’m working in the F1 business, programming 5 axis CNC milling machine what is can be really stressful. Out of work I responsible for my family and my kids, so everything what is connected to them and their future I’m 100% serious.

After all, my mother language is not english. But I don’t think this is going to be a problem.

Thanks for all your hard work and thanks for this opportunity.

Max

Would you consider yourself an emotional or logical person?

Excellent question. So I think that I’m generally quite an emotional person, in life. I have lots of friends and enjoy socialising. But when it comes to trading I like to think I am very logical, or possibly methodical. I always back test in Forex tester, and follow rules, although I think I would be more successful if I could control my emotions better. One area I struggle with is letting profits run.

How long have you been trading for and what type of strategy?

I started trading in 2014 when I opened an eToro account (big mistake!!). Lost most of my account on 2 traders. Grrrr. That got me hooked. I opened a demo account without much experience and started trading by MA crosses. Initially had great success, and so opened a real account, again big mistake, I lost half of that with over confidence on my MA crosses. I’m currently testing a multi time frame strategy on weekly (confirmation of trend), and then on daily candles off Support areas.

Do you consider your self a patient person?

Similar to question 1, I am a patient person (in life), and also waiting for a trade set up, but when I am in a trade I think I want the winnings too quickly

How much time can you spend each day learning to trade?

I am a salesman and work from home approx 1 or 2 days per week. I am currently testing an hour intraday system, and so can be available regularly. Although to be honest I couldn’t be available 8 hours per day everyday to scalp. I learn everyday by reading books (approx 1 per month), and listen to podcasts all day in the car (which is how I found 52 traders), and watch YouTube videos very night whilst I work out in my gym (garage 😉 )

Are you able to follow strict rules and not deviate from them?

Yes, if i know the system works no problem. In the past I have changed systems in draw downs, since I’ve never had someone to speak with about them. I am currently following my own rules and am doing better than ever in the past

What kind of personality do you have?

Positive, fun, optimistic. I love reading books on self development, and love learning!! I turn my car into a university on wheels by listening to all sorts of podcasts and MP3s. Ive just started to learn Spanish and listen to podcasts every day in the car.

if you pick me you are absolutely guaranteed to get my full commitment. thanks

Hello there, I live in a developing country that is on fire right now. Corruption has taken place in all levels of the government. Too sad. Trading is for me is a way to freedom me and my family from all of this bad stuff and live abroad. Get a better life doing something that I love to do (trading), raise the kids in a better and more ethical place.

I started learning to trade by myself, reading everything that I could get my hands on. Learned all the technical words (not a native english speaker), learned to work with MT4 (no one around knew what it is), tried a ton of strategies. Spend years waking up 3 in the morning to get the London open. I have been doing it by myself for 5 years, 4 hours a day, everyday. Why I didn’t give up since all the odds are against me? Because every second that I spend in learning and practicing I get a tiny closer to my dream (and I like the process of learning and practicing a lot!).

Q1. Would you consider yourself an emotional or logical person?

Logical.

Q2. How long have you been trading for and what type of strategy?

5 years. I trade forex in the higher time frames (I didn’t find a low time frame strategy that works, heard about a lot of them and tested too).

Q3. Do you consider your self a patient person?

Yes, very, very. I work in a high stress place dealing with angry costumers all day long… I deal with other people’s money… Been there for 6 years and didn’t get crazy.

Q4. How much time can you spend each day learning to trade?

4 hours a day, every day. In the weekends more.

Q5. Are you able to follow strict rules and not deviate from them?

Laser sharp.

Q6. What kind of personality do you have?

I am very curious, calm and funny. Love to learn. Always reading something.

Thanks for the opportunity!

Hi Cam and mentors,

First off all thank you for you Cam for your fabulous podcast. Also thanks for giving listeners the opportunity to be trained and mentored by successful traders.

1. Would you consider yourself an emotional or logical person?

Generally speaking I’m very analytical, so I think things through logically, not emotionally. However, having said this, I have been guilty in the past of allowing emotive aspects impact my trading. That is; taking entries too early before all the set-up rules are met, listening to news / comments and adjusting my trades, exiting too early, not cutting off losers soon enough. Happy to say, it’s this has been much better of late.

2. How long have you been trading for and what type of strategy?

On and off many times across 15 years or so… I’ve scratched the surface with many styles; Gann analysis, Long term buy and hold, value investing, options, fundamental analysis and more recently, purely technical. So it’s fair to say that I’ve been trying to find which approach and timeframe best suites my personality. For the last 1 ½ years I have been mostly back-testing various set-ups in the Australian equities market. The trades take are typically 1 week to 2 months, so only about 30 trades over this period. My results have improved from early on, to overall, break-even now.

My main strategy is to buy the retracements in stocks that have longer term upward momentum. I have created and back tested literally hundreds of different entry and exit set-up’s, though all essentially on this same premise.

3. Do you consider yourself a patient person?

Yes, sometimes too patient. I recall the 1st time I heard the quote that “95% of traders will blow their account in the 1st year”. I thought, I’m fairly disciplined, if I can manage not to blow my account in the first years, then naturally over time, I will succeed… Well, I succeeded in not blowing my account. Though, not in achieving the trading results that I really desired.

4. How much time can you spend each day learning to trade?

Weather it was postgrad studies whilst working, building small on-line businesses or working multiple jobs, I’ve never been shy of putting in the hours. I’m dedicating at least 4 hours per weekday and a lot more on the weekend to learn.

5. Are you able to follow strict rules and not deviate from them?

Yes. If I have a plan that is proven to work, you’d be silly to deviate, as you have to respect the time tested results.

6. What kind of personality do you have?

I’m a very good listener and I’m generally very patient. My background is science and I’m the type that likes working in an environment that is structured and orderly and, I like things to be done the right way.

Many Thanks

Fab

Hi Cam,

I love your podcast, found it about 5 weeks ago and I listen all the episodes I’m @ episode 65. I listen some twice or more… Please keep up this good work, and never forget: what you give is what you get… i wish you all the best.

So first of all my journey with trading is a bit hectic… If someone can turn me a successful trader, I think need to wake up early and work hard… 🙂 I couldn’t figure out how I like to trade try to find what is match with my personality. Anyway if I going to be the one who is chosen I give 110% and whatever is take to get to the point where I can say I’m arrive or fail… either way is acceptable for me because trading is not for everyone…

Please find below my answers

Please answer these questions (from my mentors) in your comment:

Q1; Would you consider yourself an emotional or logical person?

A1; If the question is trading related I’m logical because it’s pure business. But in the family side I’m really emotional.

Q2; How long have you been trading for and what type of strategy?

A2; Started 3 months ago to self educate myself, because I want to get out of this modern slavery. The strategy what I try to follow and use is a 3period EMA crosses a 13 or 21 period EMA, for trend following I have a 50 and 200MA. Checking higher timeframes for trend direction and 5 min chart for get in and out. on indicator side I like RSI and Stochastic but I prefer RSI default settings or sometimes I put a 2 period over a 12 period. I start to research the On Balance Volume, try to see the singularity between the price and the OBV, because whatever you do you can’t miss if you follow the smart money.

Q3; Do you consider your self a patient person?

A3; NO, and this is my biggest challenge with myself, and this is why I try to trade the 5 min chart, the others are a bit boring at the moment.

Q4; How much time can you spend each day learning to trade?

A4; I’m working to a weekend day shift Fri-Sat-Sun 6am-7pm but never finish before 9pm. Monday to Thursday I’m quite free just with the kids or learn and research the Forex and try to figure out what I’m doing good and bad.

Q5; Are you able to follow strict rules and not deviate from them?

A5; ABSOLUTELY, if someone tell me what I need to do to be successful and how to trade why should I not follow the rules?

Q6; What kind of personality do you have?

A6; If I start something I not give up until I get where I want to be. I like jokes, and I have a sarcastic humour, gag others if I’m bored. Others said I’m a character, don’t know is that good or not… 🙂 On the other side, I’m working in the F1 business, programming 5 axis CNC milling machine what is can be really stressful. Out of work I responsible for my family and my kids, so everything what is connected to them and their future I’m 100% serious.

After all, my mother language is not english. But I don’t think this is going to be a problem.

Thanks for all your hard work and thanks for this opportunity.

Max