Once again, it’s been a while since my last update and a lot’s gone on. Plus, there’s a lot I didn’t reveal in my last update which I’m going to reveal in this one.

Once again, it’s been a while since my last update and a lot’s gone on. Plus, there’s a lot I didn’t reveal in my last update which I’m going to reveal in this one.

If you want to get into the “meat” straight away, take a listen below, otherwise keep reading for all the “juice”:

.

Sudden life changes can be a good thing

For the past 7-8 years I’ve been searching for financial freedom. That’s why I ended up getting into trading in the first place (probably like you did too).

After a recent major change in my life I’ve discovered that financial freedom isn’t the be all and end all. Yes, it would be great but it’s not necessary to live a happy and fulfilled life.

So, here’s what happened August last year… I lost my job. Okay. I’ve said it now.

At the time it was hard to get my head around because I had always gone from job to job, spending a few years at each company. I wasn’t necessarily pushed out of this job either, well sort of.

The department I worked in went through a restructure and a few people positions were disestablished, mine included. I sort of knew it was coming but it came as a shock nevertheless.

Yes, I could have applied for the new position that had my name written all over it… more money… more responsibility… more pressure… more stress… more of what I didn’t really want.

I knew in my heart of hearts I needed to take a break from the workforce and my, already planned and paid for, month long family trip to the UK was just what I needed.

I also realized I had quite the network here in Wellington and was able to pick up work, albeit earning much less that what I was on previously, in a small start up where I was working just a few days a week.

Fast forward 4 months…

I began to realize I had been trapped in the rat race. I knew I was in the rat race before, and I knew I wanted to get out, but fear was keeping me deeply entrenched.

I also found out why I was so scared to get out (After reading a book called “How to be Free by Tom Hodgkinson“). Tom talks about how society has been structured to keep everyone anxious, everyone wanting to keep up with the Jones’, everyone wanting a steady paycheck that comes in each month, everyone wanting to have a great life when they retire.

The it hit me, “Hey, hang on, why do I want a great life when I retire?? I want a great life now! I want to be able to enjoy seeing my girls grow up, travel, meet interesting people and have enough money to do that”. How much do I really need? How much do I need to survive month to month.

This is the traders mindset.

It’s the same as a business owners mindset. You ride with the punches during the course of the month with an aim to come out on top at the end. Income isn’t steady (especially not to begin with) and you’ll have expenses that you have to pay regardless. But at the end of the month, if you get enough sales in, you should come out profitable. And if not that month, then next.

Living without a job taught me this lesson. I’d heard it many times before in interviews on this show. But it wasn’t until I was without a job that it really hit home.

Which takes me to my second point. Fear.

Now fear is a difficult one to tackle and the easiest way is to face it head on – but that’s hard to do.

Unwittingly, this is exactly what I did when I decided to pursue my passion instead of taking the safe route and applying for another role in the company.

Did I have sleepless nights? Yes. Did I feel depressed at points? Yes. Was it worth it? HELL YES!!

I broke through that fear and it taught me that I need to break through more fears before I can beat trading.

But to find out what fears I had to beat, I knew I had to start trading again. And that’s what you’re going to hear about today.

But first, another lesson…

After realizing how important psychology is to trading I decided to take a proactive steps to getting my psychology right.

One resource I’ve found particularly useful was recommended by Adam Lord from episode 58… Actualized.org.

There was a great video that talked about one simple rule for acing life. It talked about one simple secret. One change you had to make. Just one.

The one simple secret

Do things that are emotionally hard.

To become successful you have to do things that you don’t feel comfortable with. When you relate this to trading, the list is long and annoying.

My thinking now is that this is why most people can’t make trading work.

Here are just some of the things I think we all naturally avoid because they are “emotionally hard”:

- Sitting in draw down 3 days after entering a trade

- Being in a negative position immediately

- Being patient and letting the market breathe

- Investing massive amounts of your personal time for very little gain and sometimes massive loss

- Accepting that trading is a lot of hard work up front

- Letting your winners run

I dare you!

Here’s a simple way to start doing emotionally hard things… I dare anyone who reads this to do this one thing that is not just emotionally hard, but also physically hard.

“Take a cold shower”

If you do it please post a comment below and tell us how it went.

I’ve been taking them since the start of the year and I tell you what, it’s the best thing ever! Talk about getting out of your comfort zone.

Anyway, the point of this experiment is to change your state so you can start thinking of other ways to start doing things that are emotionally hard in an attempt to improve your trading.

My Foray into Discretionary Day Trading

In this update I’ll talk to you about the three different approach’s I’m taking to trading and how I’m getting on with each.

The first is discretionary day trading course I’m taking with a low profile trader who knows his stuff.

I spent the past 2-3 weeks with a group of other students learning this unique approach to trading the one minute charts. Any one minute chart in fact.

I’ve called it a highly discretionary method before but it is actually quite systematic but you need to know the different patterns to look for and there are many. Hence why I called it discretionary. You need to use your discretion to determine if something is a pattern or not.

Anyway, other things I can tell you about the course are:

- I’ve learned a mechanical way to trade the news

- I now understand how to use correlations effectively

- I now know how to approach trading the one minute chart

- I understand various money management techniques that will boost my profit exponentially

- I have a good understanding of market psychology and what’s going on at each and every candle

- I know how to use pivots to my advantage

- I have a different way to use demand and supply (zones)

- I realize golf if not a game of perfect, and neither is trading

- And a whole lot more!

Interesting Facts

While I was learning I was able to watch the master at work. Some things I just couldn’t get my head around (which is probably why my psychology is not quite there yet):

- He turned an $80 account into $28,000 in a matter of a few days

- He would happily spend 2 hours doubling his $300 account to then lose the $300 he just made in about 20 seconds – but didn’t even flinch

- Then there was his main account… 300 Lots placed on the news and it kept going against him… what happened?? Well, at some point he flipped them and went with another 300 lots in the opposite direction. Outcome: overall profit (more money than I’d make in a year)

The other interesting thing was watching the behaviour of the other students. You could see how some had worked the psychology out while others hadn’t… this helped to see where I was going wrong.

And finally, I worked out that I had some psychological issues with money that were obviously going to hold me back in my trading.

After watching another video on Actualized.org I was able to clearly see I had an issue with money. Not with spending it, but with hoarding it.

The good thing about acknowledging it is I can now do something about it. And if you watch the video too, I bet you’ll find a money issue that might be holding back your dreams of being a trader too.

How did I get on with day trading?

Sometimes a picture tells a thousand words. In this case I think it’s telling half the story. At each point where things went wrong I can pinpoint what I did to make it so. I think this is a good thing. It’s a learning process and I’m at the beginning of the journey. If I hit a home run first time, then the ego would have eventually destroyed an account or two. I’m pretty sure of that.

The positives I see, are the areas where I was break even. Two good stints. Where I was seeing small growth. This also tells me where my weakness is… letting winners run and scaling in on winning trades.

Teachers grade: More practice needed

So, Who’s the Mystery Trading Mentor?

Click this link and leave your email to find out who the mystery mentor is, and I’ll let you know when he’s taking students again.

Getting a Glimpse into Manual Swing Trading

The other education I’ve took over the past few months was learning to swing trade with Adam Lord’s free course at Royal Collective.

This course found me at exactly the right time. I knew 90% of what Adam teaches, but I never had anyone put it all together for me so it was “usable” and “profitable”.

It’s a short course and I know Adam does more in depth group coaching, but that’s all I needed to get a renewed confidence in approaching a swing trading strategy.

But to be fair, other things got in the way. So I was only able to do two trades using Adam’s methods. Both using the free setups he drops into his chat room now and again.

To my surprise, his approach really did work. Even though my first trade was a small loss, my second more than made up for it (sitting at 110 pips as I write this and my stop loss at 70ish pips profit). Here’s what it looked like on NZDUSD:

I’m finally up and running “hands free”

Probably one of my biggest revelations over the past few months was that I needed to actually “be trading” to make a go of this.

There’s only so much educating you can do before you need to put the “pedal to the metal” and go for it.

This was holding me back big time – as mention in my recent interview on Rob Booker’s Traders Podcast.

After chatting with Rob I was somehow convinced I needed to stop testing and start trading…

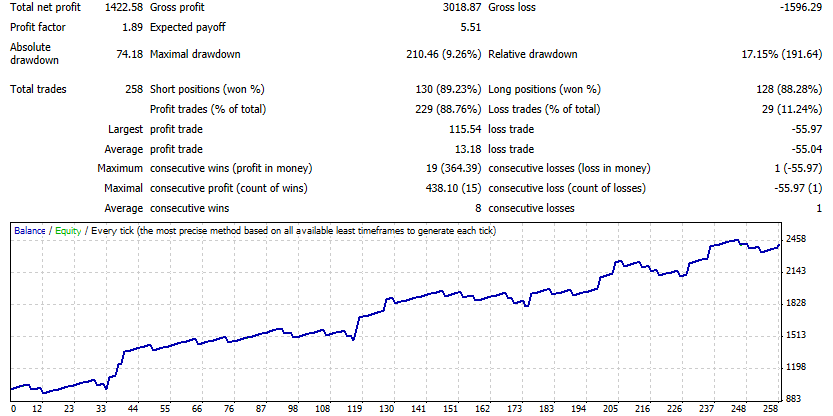

Sooooo….. I’m happy to announce that I’m back in the market with a new trading robot I created a couple of weeks ago called “RSI Simple”. Why? Because the strategy is very simple and it uses the RSI.

Here’s how it works:

Buy Entry

- RSI (14) crosses above the 30 level on the 1 minute chart

- Exit at Take Profit target or Stop Loss

- Move the Stop Loss into Profit after a certain number of pips profit

Sell trades are the opposite and work when the RSI crosses below the 70 level.

Why am I happier with this strategy, versus all the others?

- It has a positive back test over 6 years without optimization

- When optimized I can find many settings that work with different spreads

- It places enough trades to grow my account

- The winners are bigger than the losers

- It works on different currency pairs

I also decided (which might be the wrong approach but I like it anyway), that I would optimize for a more recent timeframe (6 months) and trade live with those settings.

Another thing I decided was to optimize it every month and then use new settings if the old ones are no longer performing.

Anyway, here’s my 6 month test results so you can see what I’m hoping for.

Want to join me?

If you want to join me and get your hands on these auto trading robots, then head on over to AutomateMyTrading.com where I’m giving you a free robot to try.

You can even see me build it live. Click here to get your free trading robot.

And keep an eye out for my next update when I’ll let you know how things progress with both my automation and manual trading en devours.

Hi Cam,

Another great podcast.

I think you and I must be living in parallel universes as I too have recently discovered the teachings of Actualized.org and joined the Rob Booker community. And, as if that weren’t enough, I have also recently experienced some really significant psychological breakthroughs with my own trading AND also started discretionary trading on the 1 and 5 minute charts – albeit with another of your interviewees.

As for the cold shower, I haven’t tried that yet but can certainly attest to the exhilaration of jumping into a cold swimming pool every morning when on vacation – so I look forward to giving it a go.

The RSI strategy looks pretty amazing. I hope you will make this one available to the AMT community.

I am looking forward to following your progress and wish you every success.

Thanks Kevin! SNAP!

I went to the beach for a swim last night after work with the kids, it was the first half okay day we’ve had this summer (22 deg and overcast – yes, summer has been rubbish here in Wellington)… best thing about it was the water was cold and I could only stay in for about 10 mins before I started freezing up…

Yes, I’ll be sharing the EA with members in our new Facebook group… Will try and get that up today.

Currently, it’s had 1 big loser as mentioned in the post, but since then it’s had 5 winners and is almost at break even. Plus, there’s one open trade that’s bigger than the losing trade, so it that closes in profit then it’s off to a good start.

See you in the new AMT community!

I am taking a cold shower after sporting every day since September. All through the winter… Life changing! To avoid shock and head ache, just do it progressively everytime, making wet your body part by part until you are fully under the shower. Am I trading better because of it?? For sure I am feeling wonderful and with a stronger will power.

Well done Vifra… and some good advice for everyone else wanting to try.

Hi Cam,

I DID IT! I took a cold shower. Granted, it is not too cold here in GA at 44 °F; but it was a big challenge for me. My economics teacher offered us a similar challenge 7 years ago for extra credit I thought he was crazy. This time though, the reward was the satisfaction of knowing I can do it. I am not a trader YET. In fact, I only started listening to you recently. My first podcast was episode # 58 with Adam Lord (amazing). Since then, I also go Actualized.org, another great resource. I have embarked in my journey of learning with “A beginner’s guide to day trading online” by Toni Turner. Although I don’t understand most of the details your guesses discuss, I still enjoy the podcasts & use them to narrow down on what to study. I like that you ask each guess to share their most important lessons. Great job man. You have reinforced my conviction that I can become a successful day trader.

Hi cam,

What settings have you been using for your take profit and stop loss to achieve your backtest results for the simple RSI robot?

Hi Andy,

I’m keeping them private for now. But I can tell you it’s more than 1:2 Risk to Reward on some trades and less on others.

Hi Cam,

I was listening to your podcast yesterday in the car. You started challenging people to do something that would be quiet unusual. It was something physical…. Just before you mentioned this ‘secret’ I said out loud “Taking a cold shower”! Then you said it! That was a blast! I have been doing this practice for 8 months now, and must say that it’s a great start of the day! In the beginning I had to get over the panic-reaction (gasping for air), but now its just a routine. Normally I do it 40 sec. (according to science this is enough to have the right effect). After 10 sec it doesn”t matter anymore how long I can stay under it.

I want to encourage everyone to try this great habit. Just read one of the many article on internet about it.

Thanks for all the great podcast and your excellent role as a host!

Cheers!

Haha, that’s hilarious Erik!!

Yes, it does become much easier with practice. We’re heading into winter now so the level of cold has gone up a notch… very testing!

Whoa!! I was just listening to the podcast Rob did with you and what you were saying about the 30 min mark just totally hit home so much that it caused a reaction in me that literally brought me to tears unexpectedly. I think that has been my problem( what you were discussing) and listening to you say it just really hit home in a very unexpected but revealing way. I now see this has been such a huge struggle for me and I’m ready to take up the psychological challenge to start changing this! Thanks for your honesty and transparency in this interview and for Rob for helping you to see some of your stuff in this interview.

Love this! That’s great!! It’s like AA, as soon as you admit you have a problem you can move onto the the next step of sorting your mind out.

As traders I find that psychology affects us before we even trade.