Where the heck did the first month of 2018 go? It probably got caught up in that bullish run on the Euro. February is underway and my traders are back again to give you a look into markets you may or may not be trading. Regardless we have a bucket full of predictions to sink your teeth into, from Bitcoin’s demise to the safety of Gold.

Where the heck did the first month of 2018 go? It probably got caught up in that bullish run on the Euro. February is underway and my traders are back again to give you a look into markets you may or may not be trading. Regardless we have a bucket full of predictions to sink your teeth into, from Bitcoin’s demise to the safety of Gold.

Craig’s gold prediction this month is well worth checking out. He’s done a great deal of background research for you already. It’s now up to you to decide what you want to do with it.

Where will Bitcoin end up? Well, for the past few months going long was a solid bet, but now is “short” the way to go? Who knows, but I recommend watching Nick’s tell all video.

Please note: The predictions below are for educational and entertainment purposes only, they are not financial advice and should not be used to make financial decisions of any kind.

- Junior Gold Miners by Craig Sloper

- CADJPY by Shope Aina

- USDRUB by Rob Colville

- BTCUSD by Nick Bencino

- US Treasury Bond Futures by Art Collins

- SNP by Daniel Cheung

- USDJPY by Andre Stewart

February 2018 Market Predictions

Junior Gold Miners

Gold Panning the GDXJ

By Craig Sloper

I love divergences. When 2 things that should be highly correlated start to diverge. This is what we have at present between the spot price of gold and the Junior Gold Mining ETF, the GDXJ. Spot Gold is within 98% of it’s 2016 high at the time of writing. The GDXJ, however, is at only 66% of it’s 2016 high.

I love divergences. When 2 things that should be highly correlated start to diverge. This is what we have at present between the spot price of gold and the Junior Gold Mining ETF, the GDXJ. Spot Gold is within 98% of it’s 2016 high at the time of writing. The GDXJ, however, is at only 66% of it’s 2016 high.

ADDING SUPPORT to the idea that Junior Gold Miners are about to commence a substantial rally. 1) The GDXJ has just broken above the B-D Trendline of a Contracting Triangle Formation. 2) Going through the components of the GDXJ there are a large number of them sporting beautiful Elliot Wave patterns – really nice 5 wave Motive patterns followed by 3 Wave retracements. 3) The US Stock indices are Overbrought, Over Optimistic And with The Fed commencing a reduction of there Balance Sheet, The bulls are going to loose there Funding. An expected pullback in Indicies in February should attract a Bid for Gold.

ONE CONCERN is the American Dollar. I think The Dollar is OverSold and due for a Rally, A Rally in the Dollar is bad for Gold. When you look at how the Dollar Sold off During Quantitative Easing, it’s Logical the the Dollar should appreciate during Quantitative Tightening (The Fed no longer ReInvesting Money from Matured Bonds).

SUMMARY. Passive investors could look for Long Entries in the GDXJ. Look to ride a trend and don’t sell until the price breaks below the 50MA. More Active Traders could make a Hotlist of the best moving Junior Miners and buy breakouuts from Consolidation.

Craig Sloper’s Junior Gold Miners Prediction Chart #1

Craig Sloper’s Junior Gold Miners Prediction Chart #2

Craig Sloper’s Junior Gold Miners Prediction Chart #3

CADJPY

This Beast Is to Be Unleashed!! CADJPY

By Shope Aina

Starting from the weekly time frame, we can see that the CADJPY has been rising with higher highs and higher lows. Price action is currently between the 88.550 and 87.100 zone. Looks like we may have a double bottom formation as price also rejects the 200 EMA cleanly, which could send the pair long.

Starting from the weekly time frame, we can see that the CADJPY has been rising with higher highs and higher lows. Price action is currently between the 88.550 and 87.100 zone. Looks like we may have a double bottom formation as price also rejects the 200 EMA cleanly, which could send the pair long.

I’m waiting for a break above the 88.550 level, from which I will be looking for an entry on the 4hr time frame long. Preferably a pullback entry. My bias for this pair this month is long. Lets see what happens..!!

Shope Aina’s CADJPY Prediction

USDRUB

Do We Have a Long-term Buy for USDRUB?

By Rob Colville of TheLazyTrader.com

It’s make or break time for USDRUB on the weekly timeframe as price reaches a critical level. We discuss a potential buy opportunity if we get US Dollar strength this week.

It’s make or break time for USDRUB on the weekly timeframe as price reaches a critical level. We discuss a potential buy opportunity if we get US Dollar strength this week.

BTCUSD

Is Bitcoin Headed Back to $7,500?

By Nick Bencino of Forex4Noobs.com (Forex) & Cryptos4Noobs.com (Cryptos)

Is Bitcoin headed back to $7,500? The hype might be over, but these recent pullbacks have me excited!

Is Bitcoin headed back to $7,500? The hype might be over, but these recent pullbacks have me excited!

US Treasury Bond Futures

T-Bonds May Outrace Market to the Upside in February

By Art Collins of ArtCollinsTrading.com

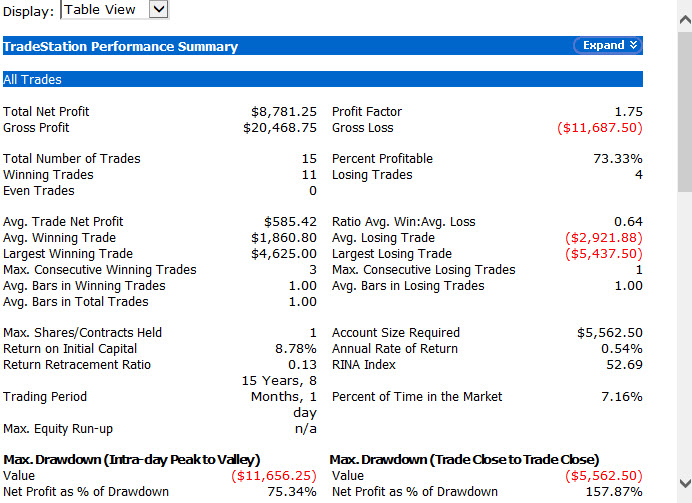

Being primarily a stock index futures trader, I find myself in a movie I’ve seen a few times before. The market has gone too high to quickly making it hard to buy, but shorting it tends to be suicidal. So I’m turning my attention to the 30-year T-Bonds.

Being primarily a stock index futures trader, I find myself in a movie I’ve seen a few times before. The market has gone too high to quickly making it hard to buy, but shorting it tends to be suicidal. So I’m turning my attention to the 30-year T-Bonds.

February tends to be a good month to buy them. The longer term should be downward, particularly given the fundamentals of the government slowly unwinding their long position. I’m thinking that move will wait a bit and that the monthly tendency is the most reliable one. The included chart shows the last 15-year result of buying it at the opening on the first February opportunity and exiting at the last.

Art Collins’ US Treasury Bond Futures Prediction

S&P 500

S&P Reaction

By Daniel Cheung of Free FX Telegram – https://t.me/freefx1

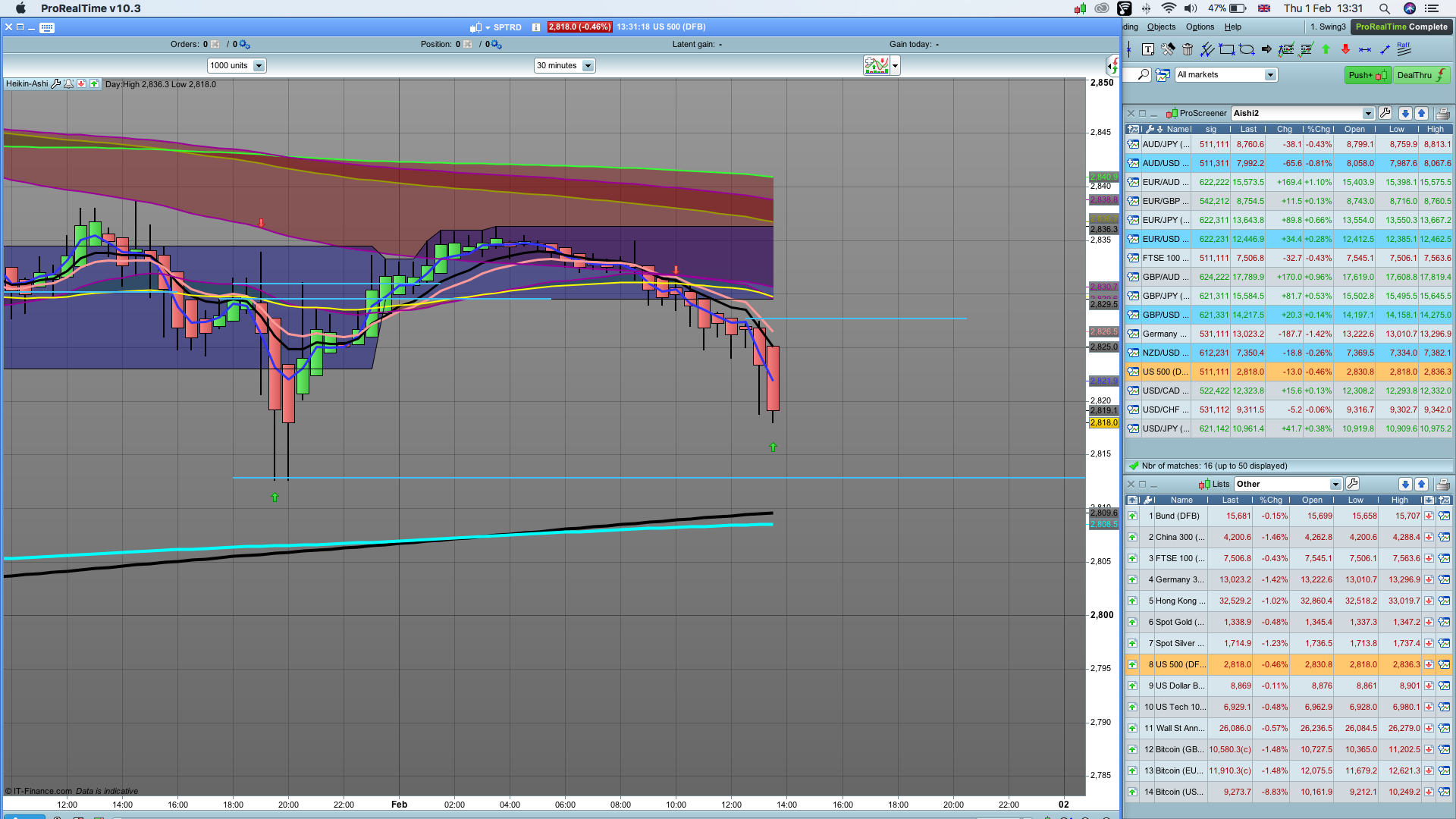

S&P 500 has done its run up for ages now, during the reaction has be great and loads to be taken in. Technical wise the chart was set up from last week, with a reaction and then a confirmation on the charts – refer to last week of January.

S&P 500 has done its run up for ages now, during the reaction has be great and loads to be taken in. Technical wise the chart was set up from last week, with a reaction and then a confirmation on the charts – refer to last week of January.

Fundamentally US are having alot of problems, from Trump, FBIs and all other issues economically too.

Chart is an example of the 2 shorts taken totalling 300 pips 30 points.

APM Course details:

Teaching you A-Z about trading and strategies available with a £500 discount code ‘52 traders‘ only 10 coupons.

Daniel Cheung’s S&P Prediction

USDJPY

Further Downside Pressure for the Dollar?

By Andre Stewart of 52traders.com

Here is a brief run down of USDJPY.

Here is a brief run down of USDJPY.

With the fundamental landscape of the dollar is not looking to good. I would expect that UJ to still look to move to the downside.

Looking at UJ it is always a good idea to have a look at Gold as a reference due to the inverse correlation.