I can’t believe it’s been 4 months since my last update in December.

I can’t believe it’s been 4 months since my last update in December.

And now I’m out of the 9-5 grind, I have more time to put together great trading content for my listeners, and this update is no exception!!

Check out what’s in store…

- Watch (or listen in on) 2 of my listeners as their trading issues are diagnosed by my mentor, Andre Stewart (who once again, shares way too much)

- Check out my “Snake Encounter Video”

- Hear all about my close call with a “Shark” in Oz

- Learn why “filtering” is so important for us traders and how it tripped me up

- Learn the simple Supply and Demand strategy I’ve been using

- Check out the killer EURUSD signal I took from Daniel Cheung

Plus, there’s two new things for you to sink your teeth into!

- Pro Member Trading community – where you can chat with other traders, share charts and most importantly “learn from experienced traders” who have featured on the show

- Mini Courses have launched too!! – learn from my past guests as they dive deep into niche trading topics, to give you an edge

See! I told you I’d be pulling out all the stops for you guys. Let’s get underway…

First listen to the full length episode

Includes the audio only version of the “trading issues diagnosed” session with two of my listeners.

Watch the “Trading Issues Diagnosed” Video

Everything is better with pictures – unless you’re doing something else… in which case a podcast is actually better 😉

If you’re a Gold Member simply login to watch.. If you’re not, simply click here to join.

Oh, and if you want your own trading issues diagnosed, hit up Andre over at ChartArtistTrading.com where he’ll diagnose your issues free of charge.

My close encounter with a snake… And a shark?

So, I took the family to Australia for Christmas. A holiday I’ve done many times before. Since the age of two, in fact.

Given my Mum is an Ozzie, we were always visiting her family in Sydney as kids.

This trip was to Queensland, where I tend to consider the wildlife a little bit more “wilder” than the big city life of Sydney.

If you’re an Ozzie reading or watching this you’ll probably be thoroughly underwhelmed – snakes, spider and sharks must be what flies and ants are to the rest of us.

Anyway, I was able to capture my snake encounter on video which you can check out below (the ‘shark’ one was a bit too hard, as you can imagine)…

What made the whole experience even weirder was the fact that my nephew (who had come out from England to join us) says “All I want to see in Australia is a big massive snake and a big massive spider”… Literally 3 seconds before we ran into it.

Now, the shark story comes across better in the audio, so jump to 3 minutes 20 seconds and you’ll hear all the gruesome detail.

Back to trading & why “Filtering” is so important

Over the past 4 months I’ve managed to acquire the knowledge of a professional trader and understand the tools big institutions use to trade. All thanks to the help of my mentor Andre.

However, even though I had all the knowledge to spot market turning points and time the market perfectly… Something was missing.

I had the curse of too much knowledge.

Within my arsenal I had upward of 10+ price action approaches to call upon.

I had failed to filter what I had learnt.

And by failing to filter I had failed to master.

As the saying goes “Jack of all trades, master of none”

Well, I wasn’t quite as bad as the dog. Far from it.

I just had too many ideas, to many entry opportunities. I could justify an entry point out of thin air.

Excitement played a big part too.

I was excited to get started with my new found knowledge. Too excited to spend days or weeks back testing and training my subconscious to spot each setup. So I jumped in head first and… what do you know? I got a sore head again.

After chatting with Andre I realized I needed to go back to the beginning and build up a strategy from the gound up.

Did I take his advice? Yes.

Did I do what he said? No.

Why? Ego got in the way.

Hidden ego, that for some stupid reason, unknown to me, forced me to find an “easier (also less effective)” route – not the route I was shown which would take a bit of practice to perfect.

My ego told me, I can come up with a simpler way, an easier way, “Ignore the proven path to success, you’ll be fine on your own”… Don’t we all love that ego.

Anyway, skipping forward…

I decided to go back to where I started and eventually came up with this system:

Cam’s M30 Supply & Demand System

Now, when this worked it was great.

But waiting for the setups seemed beyond me. Especially given I had the been creating setups out of thin air.

This system soon went by the wayside as I searched for something that would give me more opportunities.

Then the change happened

I finally managed to park my ego and accept what Andre was telling me. I stopped trading any ideas I’d come up with that did not originate from Andre.

Here are the changes I made which have helped me turn a corner:

- Honoring my Stop Loss – this was the first thing to master. I had been destroying my days gain by not wanting to take a loss when my new approach called for it.

I’m now comfortable with losing. Tick!

- Sticking to a system/approach – easier said than done. But I’ve finally done it… And it was hard. Probably the hardest thing of them all. I wanted to give up on it about 10 times after deciding to stick to it. Now it’s finally paying dividends. If you want to find out how it works your best bet is to have a chat with Andre – he is the master.

Here’s a recent trading day (a day or two after recording this show). See how I honored that stop on trade 3… Now that’s what I’m talking about!

Want to keep abreast of my progress, in between these updates? Yep, you guessed it. Just join the community.

Dan’s “Free Signal Friday”

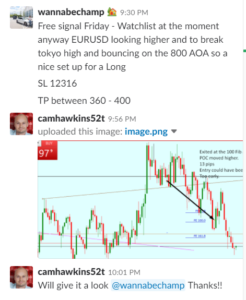

While I almost never take signals, after watching Daniel Cheung post winner after winner for months on end (in Andre’s Slack group) I felt pretty confident about taking his call last Friday.

It netted me 24 pips on EURUSD overnight. I haven’t let a trade run overnight for a long time. But such was my confidence in what Dan does combined with where I’m at with my trading knowledge, it felt quite comfortable.

Here’s the call:

You can see how it played out and to listen to Dan’s episode here

That’s it for this update.

The main thing is that I feel I’ve turned a massive corner (one I’ve passed by many times before).

The challenge now is to maintain momentum, discipline and with that will come consistency.

I hope your trading is on the up too!

I would love to see what you’re up to with your trading, and how you’re getting on. Just jump in the Pro Member community, it’s where I’ll be posting most of my trades: