It’s been a while since my last update and although I’ve been up to a lot I’m still yet to crack the markets.

On the flip side, I feel I’m in a much better position now than I was a year ago and in today’s update I reveal just few of the things that are contributing to my optimism. These, along with the knowledge that most of my guests took 5+ years to really become successful, leaves me in a happy place.

The March 2016 update includes:

- What I’ve been up to since my last update in September 2015

- The launch of my course that teaches Automated Trading

- How my live trading has been performing

- Some automated systems I’m trading live

- How I’m using Hypnosis to help my trading

- A “value packed” email from a successful trader (who didn’t want to come on the show)

- A special treat for three of my listeners

“Bear Grills Wannabe” hits Thailand

It’s been a long old time since my last update in September 2015 and I want to give you a quick update as to what I’ve been doing so you can connect the dots if you’ve been listening to my journey so far.

So, in November I spent 3 weeks away from the family, with a mate, in the middle of no-where Thailand trying my best to do a Bear Grills impersonation – albeit without insects on the menu or drinking my own urine.

Here’s a video I took to let you know I hadn’t forgotten about you guys… even in the middle of the ocean.

Getting told off in the middle of the ocean…

(Ignore the suntan lotion… mirrors were in short supply)

Having fun in Thailand (apart from the fishing)

Introducing My New Course On Automating Your Trading

After returning from Thailand I wanted to teach time poor or poor timezone traders (like myself) to automate their strategies so they could get a full nights sleep, enjoy life and still be successful in the markets – just like past guests Tim Rea, Kevin Davey and Andrea Unger do.

So I embarked on a 3 month journey, putting an online course together to teach people how to turn their strategies into software.

The course includes:

- 8 video based training modules

- 15 automated systems to download, adapt, learn from and trade

- a community

- and a heap of value bombs you probably weren’t expecting

- Oh, and not to mention I’ve partnered with He Shuhan who’s running live masterclass sessions teaching traders how to build solid automated strategies

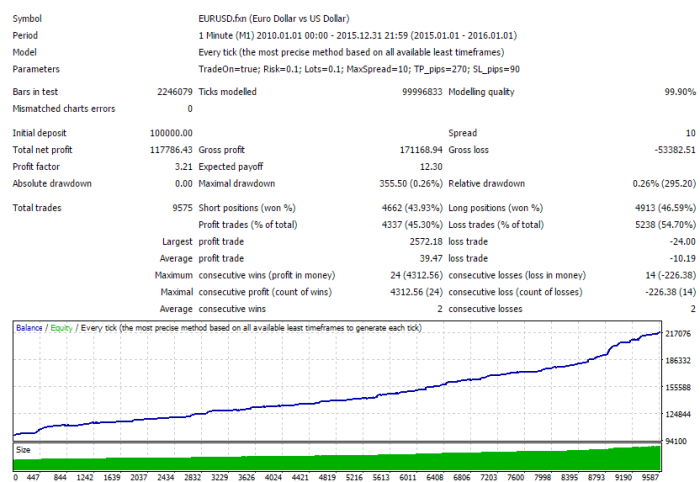

In fact, here’s one he threw together in a matter of days:

And to top it off, here’s what one of the founding members had to say about the course :

“This course is absolutely superb & amazing value for money.”

I am in no way affiliated with Cam Hawkins & purchased his course after trying out the EA he showed on his Youtube video. Having been ripped off more times than I care to remember by dishonest vendors in this online trading environment, I knew I was taking a risk. Well all I can say is this is the best money I have ever spent. This course is absolutely superb & amazing value for money. The EA’s that Cam gives away with the course are worth several times the price of the course alone, never mind the excellent video tuition. He also includes at the present time 11 proven profitable trading methods for converting to EAs. After watching the fisrt few videos I made my own EA which produced a steady positive equity curve over 5 years without curve fitting. I am so looking forward to putting into practice the rest of the material from the videos. As the community grows it will only get better as we share EAs & trading ideas. Thank you Cam for putting this together. Kevin D, UK

Needless to say, I’m very happy the course hit the mark!

If you’d like to see if it’s the right fit for you then you can Sign Up to my Free Mini Course here, while the doors are closed.

Where’s My Trading At?

After creating the course I had a number of strategies I wanted to try automating.

What I’ve found is that it’s not that hard to come up with a strategy that is profitable over the long term; here are a couple I came up with:

It’s more about the questions I start to ask myself when it’s time to put real money behind them:

- How much shall I risk?

- How much can I risk before ruin?

- Will this strategy survive any market condition?

- Will it trade enough to contribute to my income replacement?

- Have I optimized it enough or too much?

- Will my broker act the same as my test environment – even though I have them in sync?

As you can see, it’s not as simple as it seems.

Anyway, I worked through things and decided to trade the following two strategies, albeit with some hesitation.

The DAX Strategy

I came up with some amendments to Andrea Ungers Daily DAX breakout strategy, based on recent market optimization and have traded it live for a few weeks now with some frustration. Well, mainly one frustration – the only day it made a significant gain I had reloaded the software onto the chart and forgot to update the Lot size so it was the same as the prior two losing trades. The end result was a good winning trade with only 20% of the Lot size traded… Doh!

And just yesterday when my profit went sky high during my night, which would have given me a healthy profit, I woke to find it only a dollar or two away from breakeven. I’d seen this sort of thing happen before and was almost certain it would hit my SL. I exited only to find I would have made another “okay” profit.

So, stepping back, I need to learn from these mistakes and be less reactive to what’s going on and believe in the research and analysis I’ve done beforehand… I also need to be more serious when setting up my software to trade. Rushing to do it cost only a few dollars this time, but when I start increasing risk, a mistake like this has the potential to set me back months.

The Strong Support & Resistance Strategy

This is another creation of mine. It has a 1:3 risk to reward ratio which I like, but the winning percentage is low and it does go through some down periods before a few winners take it back into profit territory.

I’m trading the minimum lot size to see how it goes on my broker at the moment, but I feel that I’m only doing this to let you, the listeners, see some account stats at the end of each month. Probably not a strategy I’ll continue with as I’m not 100% confident about the outcome or how it trades.

Now the truth (it hurts a little)

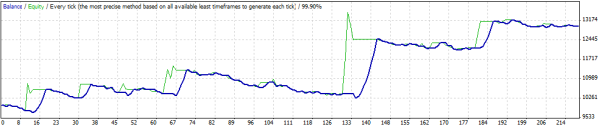

So you’ve seen the long term view, now let’s look at the short term picture and my live account:

Not the upward slope I was hoping to show you and I think that’s been some of my downfall… Yes, trying to be an active trader for these updates may be forcing my hand to trade when I’m not ready.

So, I’m falling back to my “no trading policy” until I’m happy the next time I place a trade I’m 100% confident in what I can expect.

Hypnosis Help for Traders

I’ve mention hypnosis before in a very early episode with Norman Hallett. I’ve used it in the past for various things, like trying to cure Hay Fever. At the time it didn’t work, but surprisingly enough this year my Hay Fever disappeared!

I’ve also mentioned Self Sabotage in previous episodes, and wanted to do something about it. So, I went on my favorite hypnosis site to order some Hypnosis mp3’s that I listen to before going to sleep at night that aim to fix any self-sabotaging I may be doing (among other things). The ones I’m going through at the moment are:

- Be Less Negative Pack, which includes

- Stop Negative Thinking Now

- Self Sabotage

- Stop Complaining

- No Regrets

- Improve Your Mood

I’m mainly rotating through 1-3 listed above as I have no regrets and my mood is good 😉

If you’re struggling with the emotional side of trading then I do recommend Hypnosis as a good way to help overcome this… or any other problem you have.

An Email From A Successful Trader

He didn’t want an interview but left me with a tonne of value in his reply, have a read:

“Cam:

I have had a chance to look over your web site and have listened to a couple of your podcasts. I admire your goal to help people who want to become successful traders.

But I’m afraid that I don’t really have anything encouraging or useful to say to your members.

You see, I think it is virtually impossible to be a successful part-time trader unless you first have been a successful full time trader.

I think there are two ways to become a successful full time trader.

The best way to to learn from watching someone who does it – these opportunities are rare.

The only other way is to learn by immersing yourself entirely in the activity of one market, watching every tick, and asking yourself how you can anticipate market’s moves up and down from its highs and lows. I believe that before you can beat the market you have to become part of it.

I don’t think you can learn much if anything from books – except possibly the importance of loss control – a very important message indeed. The only thing I use in my own work which I learned from books is the significance of the Fibonacci numbers. Everything else I use I invented myself.

I have watched every tick in the S&P futures in real time since trading started in April of 1982. And I watched every tick in the bond futures for 25 years until I stopped trading them in 2005. I learned to trade by trying to make sense of what I saw the market do during trading sessions, not by reading books on the subject of trading. My interest in trading dates to 1965 when I started keeping daily records of the market averages and the advance-decline numbers. But It took me many frustrating years to become successful.

People don’t ask themselves why it should be possible for them to make a money part-time trading by simply reading some books on the subject or by buying a trading system, etc. I know of no successful part-time doctors, lawyers, computer programmers, etc. Success in trading requires at the very least the same commitment of time and effort as any other profession.

And of those few who make this commitment even fewer achieve their goal. The reason is that trading is the MOST competitive business activity I know of. The great financial rewards attract the very best and shrewdest minds. And for a few hundred dollars anyone can play the game. So competition for profits is cutthroat.

I think the path to becoming a professional trader is very similar to the path one must take to become a professional poker player. No sane poker player is going to pay $10k to buy a seat at the Word Series of Poker until and unless he or she has spent thousands of hours actually playing poker against good players – online or at local casinos. Yet lot’s of people read a few books on trading, then happily plunk down $10k in a brokerage account and start trading.They have bought a seat in the Word Series of Poker. But they are actually the suckers at the poker table of traders.

So I must respectfully decline your generous invitation to join you in a podcast. I think my views would discourage your members and this would do you no favor.

Cordially,

Anon”

Wow! What a value packed email. It’s a shame he didn’t want to feature on the show, but nevertheless there’s a tonne of value in his email and lessons for us all.

My top take outs were:

Be focused

- Pick a market, study it, understand it and realise it’s going to take time (chart time) to get your head around it

Educate then validate

- Don’t blindly buy a hand at the world’s biggest poker table without validating what others have taught you and getting some game time under your belt

Special Treat for 3 Listeners

Finally, watch out for episode 31 where I have a special treat for 3 lucky listeners out there. All will be revealed in the episode, so subscribe to my email list, via itunes or whatever android app you’re using to hear it first.

Until next month!

Have a question, please leave a reply below.