Sometimes something is so good that you don’t want it to stop.

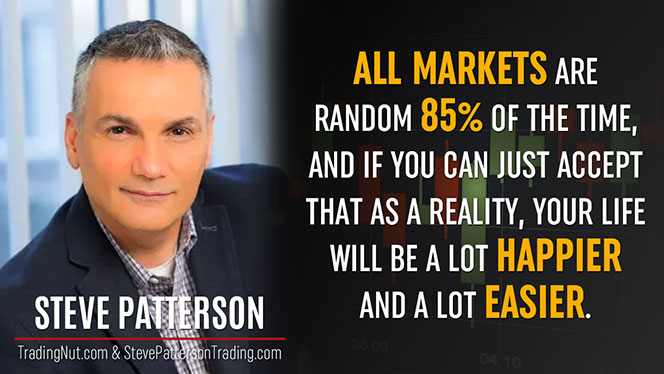

That’s what it felt like during my interview with Steve Patterson – a veteran stock trader from Canada.

Steve’s story is one most traders can relate to, other than the fact that Steve took opportunities, throughout his life, that most of us don’t.

For example: working at a Stock broker for free in a “Boiler Room” scenario and earning the title “Cold Call Cowboy” or spending time on the trading floor (not as a pit trader but as a runner).

Steve’s interview is packed full of nuggets and wisdom – so much so, he earned himself a second interview in the future.

Oh, and don’t miss out on Steve’s “Trading Nut” Listener Offer below the interview…

Podcast Interview

GOLD SPONSOR

Save Up to 45% on Trading Capital

Get funded up to $400,000 with low profit targets and an 85% profit split.

CLAIM YOUR 45% COUPON →Interview Links

StevePattersonTrading.com

Skype – SSPTrader

Steve’s Strategy of the Week

Key Lessons

[06:36] I found out much to my surprise even though I was really terrible at math, I had an aptitude for understanding companies and that kind of spur my interest in the markets.

[10:20] Nobody would hire me because I didn’t have a university education, even though I had my license I couldn’t get a job as a broker.

[13:39] Bottom line is that after the market crashed, I realized that I knew nothing about trading. Absolutely nothing!

[18:16] When you’re on the floor although they’re trying to hide things, it’s really easy to see the order flow because you can see who’s doing what and then you can see how the price reacts to that.

[24:17] The only advantage that a prop firm gives you is that you’re sharing commission volumes with several other people so your rates can come down.

[25:30] Every time I try to trade somebody else’s money, I’ve got memories of 1987 in my brain that are absolutely terrible.

[26:28] I always tell people I have no respect for you until you traded for seven years.

[27:04] There are so many things that can affect you as a trader.

[30:07] If I don’t sleep 9 hours, I can almost guarantee you I’m gonna have a losing day the next day.

[35:21] The market exists to separate you from your money.

[42:12] The easiest way to make money is in the Stock market.

[43:15] Equities are the easiest asset to trade because you have so much choice.

[47:00] If you’re making money, the market maker can’t make money because he’s usually the one selling it to you.

[48:05] All markets are random 85% of the time and if you can just accept that as a reality, your life will be a lot happier and a lot easier.

[52:53] I’m not a patient person so I trade what suits my personality because if I try to be a patient person, I ended up losing a lot of money.

Steve’s Trading

- He’s been attracted to the market since he’s in high school

- He worked for free just to get experience as a stockbroker

- He managed to become a stockbroker even though he had no university education

- After the market crashed in 1987, he worked at a company selling cellphones

- He worked with several Proprietary firms

- Until today, he’s still trading with prop firms

- He was able to become a consistent trader after 3 years of trading – and after getting rid all of his indicators

- He doesn’t trade the next day if he doesn’t sleep for 9 hours

- He’s traded everything – Forex, Options, Stocks, Equities

- He trades assets that suit his personality